Welcome to jobs Friday. The December nonfarm payrolls report arrived with arguably greater than usual heft as investors appear increasingly nervous about surging government bond yields amid signs of revived inflation.

Equity bulls were hoping for a payrolls number that was not too hot and not too cold. However, a notably stronger-than-expected report is pushing Treasury yields to fresh multi-month peaks and forcing equity index futures lower.

However, one bubblicious sector of the stock market may have struggled to rally regardless of whether the jobs numbers gave equity bulls what they wanted.

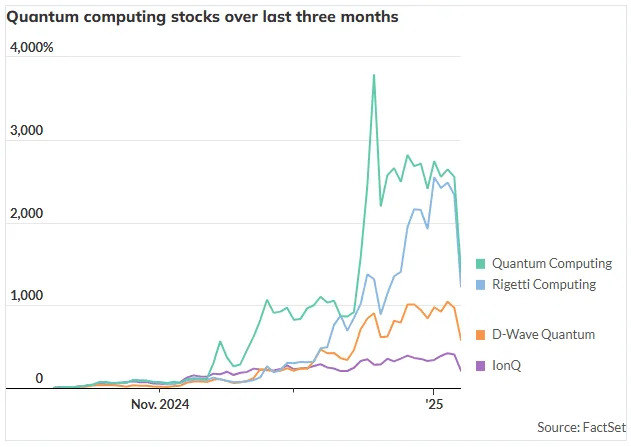

Small quantum computing stocks dived this week after Nvidia NVDA CEO Jensen Huang made clear to investors what they should have already known. Talking to analysts at the CES convention in Las Vegas on Tuesday, the executive said that “very simple quantum computers” could still be 20-years away.

The reaction among quantum stocks favored by retail investors in particular was swift and brutal . Shares of Rigetti Computing RGTI, which in the previous three months, for example, had surged more than 2,000% tumbled around 45%, Quantum Computing QUBT slid 43%, IonQ IONQ plunged 39%, and D-Wave Quantum QBTS dived 36%.

However, that still leaves many of these stocks with huge gains over recent months. Again, looking at Rigetti, its stock was less than a buck in October, and by close on Thursday was $10.04.

And that means such stocks should continue to be sold short, according to Martin Shkreli, the investor who was sent to prison for securities fraud and whose defense of sharp drug price hikes by a company he controlled earned him the nickname “Pharma Bro.”

In a long message on X this week, Shkreli said quantum computing stocks “are so humorously overvalued, they conjure the dot-com bubble.” Several of them had downside of 90% or more, he added.

Shkreli’s X message contained an explanation of quantum theory and its use in computing. He applied his reasoning to the four companies noted above and their various approaches to utilizing the technology.

IonQ gets Shkreli’s respect for its “academic achievements” and he noted the company’s revenues appear to be growing, with $41.6 million in annual revenue for 2024, according to FactSet estimates. “The company has talked about putting out a 100-qubit computer called Tempo by the end of this year. Unfortunately, IBM is already far ahead of this scale,” he said.

Still, Shkreli has a fair value of $11.23 for IonQ. Though that’s way below the current $30 share price it still implies the company has prospects. In contrast, fair value for Rigetti he says is $1.00, while he considers D-Wave and Quantum Computing, which had revenue of just $101,000 in the third quarter, have fair values of 1 cent apiece.

In a message dated December 8, Shkreli said he was short IonQ and Regetti — though he didn’t say at what level he sold. Anyway, he’s maintaining the strategy.

In this week’s missive he said: “For those who want me to cut to the chase: I recommend shorting D-Wave Systems, Rigetti, IonQ and Quantum Computing Inc”.

And he added that he doesn’t think quantum computing will be material to Alphabet GOOG or IBM IBM. “The misunderstanding seems to be the idea that quantum will ‘change everything’. No. It will help a few nerdy people, like me, study cryptography and odd, but useless mathematical problems, more easily. That is not a big industry,” he concluded.

Markets

U.S. stock-indices SPX DJIA COMP are lower at the opening bell, while benchmark Treasury yields BX:TMUBMUSD10Y rise. The dollar index DXY is pushing to multi-month highs, while oil prices CL.1 jump and gold GC00 is trading around $2,685 an ounce.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5918.25 |

0.62% |

-2.73% |

0.62% |

23.72% |

|

Nasdaq Composite |

19,478.88 |

0.87% |

-2.78% |

0.87% |

30.12% |

|

10-year Treasury |

4.698 |

9.60 |

30.20 |

12.20 |

75.43 |

|

Gold |

2709.2 |

2.13% |

1.62% |

2.65% |

31.93% |

|

Oil |

75.68 |

2.17% |

6.46% |

5.30% |

4.01% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

The December nonfarm payrolls report showed a net 256,000 jobs were added, up from the downwardly revised 212,000 in November, and higher than the 155,000 expected by economists. The unemployment rate dipped to 4.1% from 4.2%, while month-on-month hourly wages grew 0.3% against 0.4% in November.

Other U.S. economic data due on Friday include the University of Michigan consumer sentiment report at 10:00 a.m.

Nvidia NVDA stock was impacted by a Bloomberg report saying the White House will introduce new restrictions on artificial intelligence chip exports .

Constellation Energy CEG has agreed to buy privately held Calpine in a $26.6 billion deal that combines two of the U.S.’s largest electricity generators.

U.S.-listed shares in Taiwan Semiconductor Manufacturing TSM are up after the world’s largest chip maker reported record revenue in the last quarter of 2024 .

The Supreme Court will hear an appeal from TikTok on a looming U.S. ban that could impact rivals Meta Platforms META and Snap SNAP.

Shares of insurers including Chubb CB fell, while homebuilders including Toll Brothers TOL rose, after the fires that hit the Los Angeles area.

The People’s Bank of China said it will stop buying the country’s government bonds after yields fell to a record low.

Best of the web

The CEOs who are tearing up the policies Trump hates.

How analyst job cuts on Wall Street are reshaping equity research .

Chinese ship suspected of cable sabotage may have had two AIS devices .

The chart

Here’s a worrying chart for crypto enthusiasts, courtesy of Kim Kramer Larsson, analyst at Saxo Bank.

“Bitcoin forming a Shoulder-Head-Shoulder top and reversal pattern not yet confirmed. A break below Neckline support at around 90,680 will confirm with downside potential to 73,000,” he says.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

GME |

GameStop |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

HOLO |

MicroCloud Hologram |

|

RGTI |

Rigetti Computing |

|

MSTR |

MicroStrategy |

|

PLTR |

Palantir Technologies |

|

NIO |

Nio |

|

MVST |

Microvast Holdings |

|

QBTS |

D-Wave Quantum |

Random reads

Walter White’s home goes on the market.

Aussies just can’t copa with all these cabanas .

Pizza chain expansion plans thwarted because town’s kids are ‘too fat’.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .