Fragrance and perfume company Inter Parfums (NASDAQ:IPAR) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 10% year on year to $361.5 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.51 billion at the midpoint. Its GAAP profit of $0.75 per share was 5.7% below analysts’ consensus estimates.

Is now the time to buy Inter Parfums? Find out in our full research report .

Inter Parfums (IPAR) Q4 CY2024 Highlights:

Company Overview

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ:IPAR) manufactures and distributes fragrances worldwide.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.45 billion in revenue over the past 12 months, Inter Parfums is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

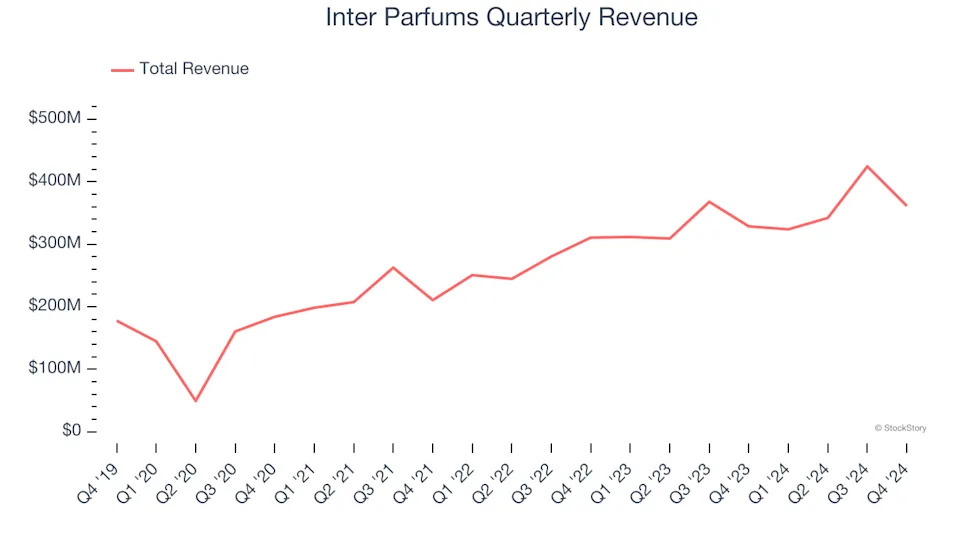

As you can see below, Inter Parfums’s 18.2% annualized revenue growth over the last three years was impressive. This is encouraging because it shows Inter Parfums’s had strong demand, a helpful starting point.

This quarter, Inter Parfums grew its revenue by 10% year on year, and its $361.5 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

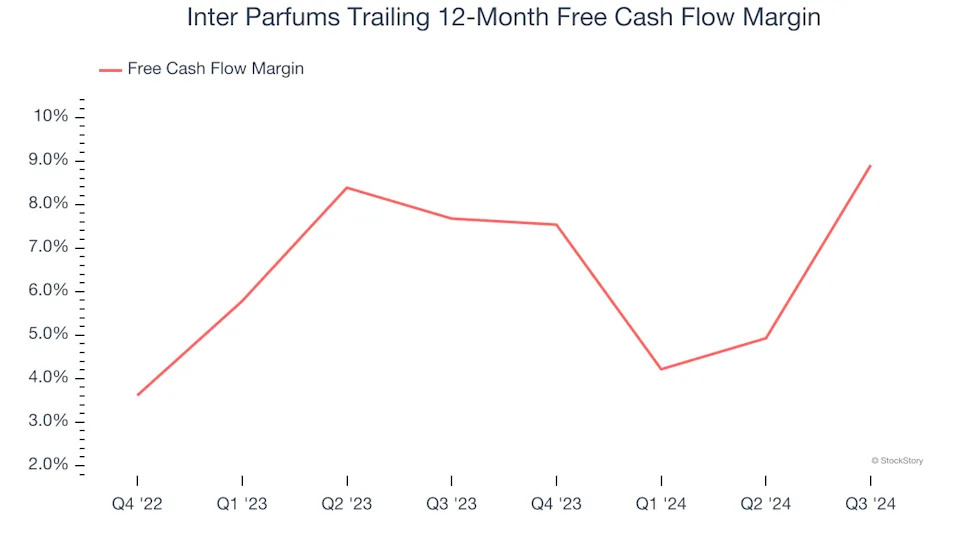

Inter Parfums has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.1% over the last two years, slightly better than the broader consumer staples sector.

Key Takeaways from Inter Parfums’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its gross margin fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $139.06 immediately following the results.

Is Inter Parfums an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .