Tax and accounting software provider, Intuit (NASDAQ:INTU) announced better-than-expected revenue in Q4 CY2024, with sales up 17% year on year to $3.96 billion. Guidance for next quarter’s revenue was better than expected at $7.58 billion at the midpoint, 1% above analysts’ estimates. Its GAAP profit of $1.67 per share was 98.1% above analysts’ consensus estimates.

Is now the time to buy Intuit? Find out in our full research report .

Intuit (INTU) Q4 CY2024 Highlights:

"We are making great progress fueling the financial success of consumers, businesses, and accountants with our AI-driven expert platform," said Sasan Goodarzi, Intuit's chief executive officer.

Company Overview

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Tax Software

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

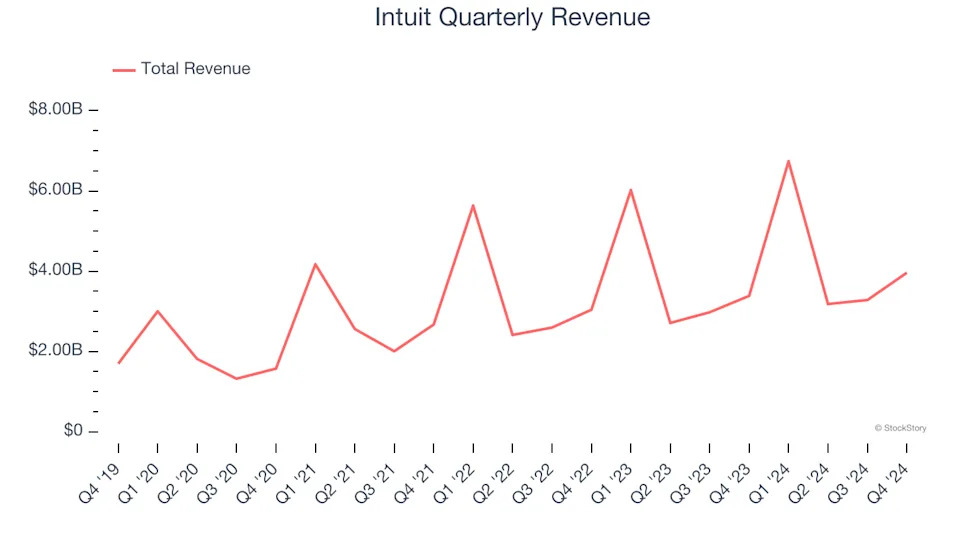

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Intuit grew its sales at a 14.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Intuit.

This quarter, Intuit reported year-on-year revenue growth of 17%, and its $3.96 billion of revenue exceeded Wall Street’s estimates by 3.5%. Company management is currently guiding for a 12.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.9% over the next 12 months, a slight deceleration versus the last three years. We still think its growth trajectory is satisfactory given its scale and suggests the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

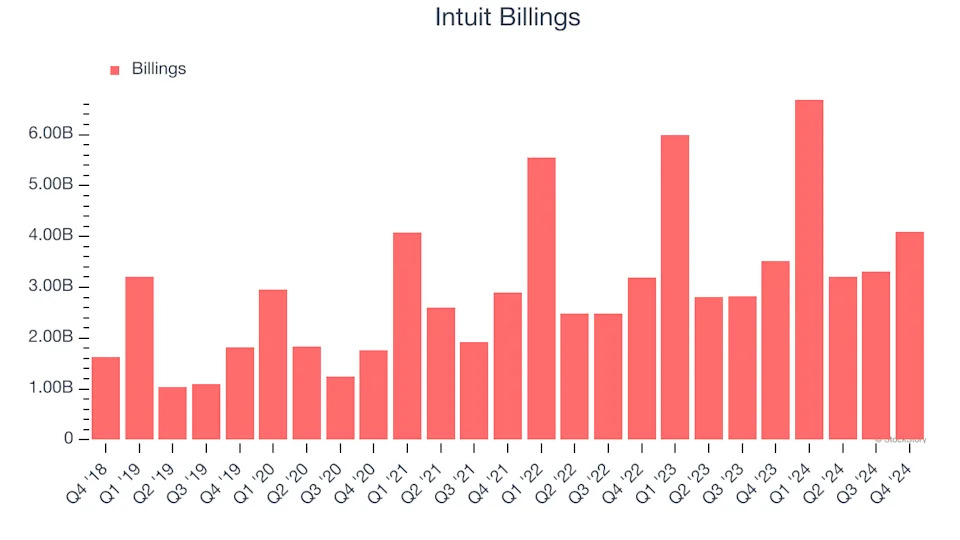

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Intuit’s billings punched in at $4.10 billion in Q4, and over the last four quarters, its growth was solid as it averaged 15% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Intuit is extremely efficient at acquiring new customers, and its CAC payback period checked in at 12.2 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give Intuit more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Intuit’s Q4 Results

We enjoyed seeing Intuit beat analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance was in line. Overall, this quarter had some key positives. The stock traded up 2.9% to $571.20 immediately following the results.

Intuit put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .