Online marketplace eBay (NASDAQ:EBAY) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $2.58 billion. On the other hand, next quarter’s revenue guidance of $2.54 billion was less impressive, coming in 2.3% below analysts’ estimates. Its non-GAAP profit of $1.25 per share was 4.3% above analysts’ consensus estimates.

Is now the time to buy eBay? Find out in our full research report .

eBay (EBAY) Q4 CY2024 Highlights:

"eBay achieved three consecutive quarters of GMV growth to end 2024, and we took significant steps toward our vision of reinventing the future of ecommerce for enthusiasts," said Jamie Iannone, Chief Executive Officer at eBay.

Company Overview

Originally known as the first online auction site, eBay (NASDAQ:EBAY) is one of the world’s largest online marketplaces.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

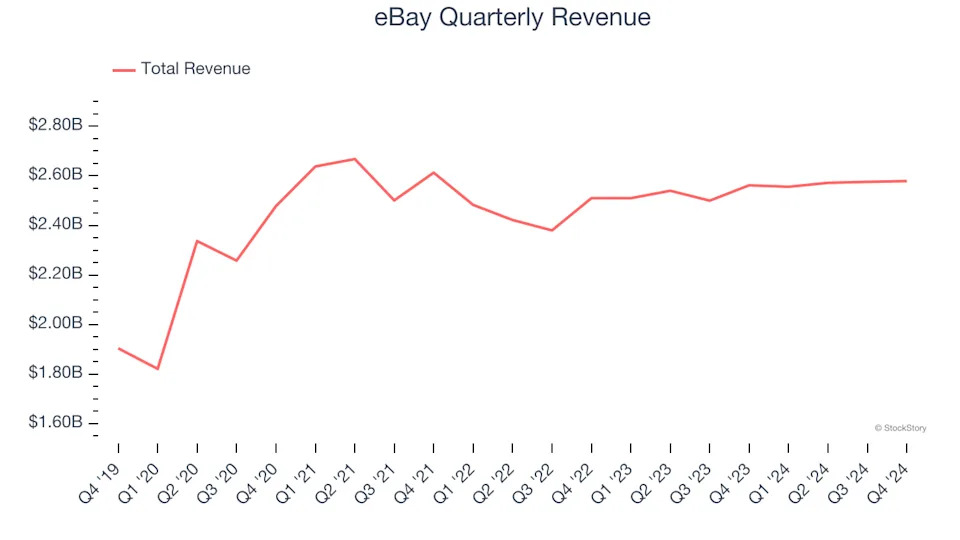

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, eBay struggled to consistently increase demand as its $10.28 billion of sales for the trailing 12 months was close to its revenue three years ago. This was below our standards and suggests it’s a lower quality business.

This quarter, eBay’s $2.58 billion of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Active Buyers

Buyer Growth

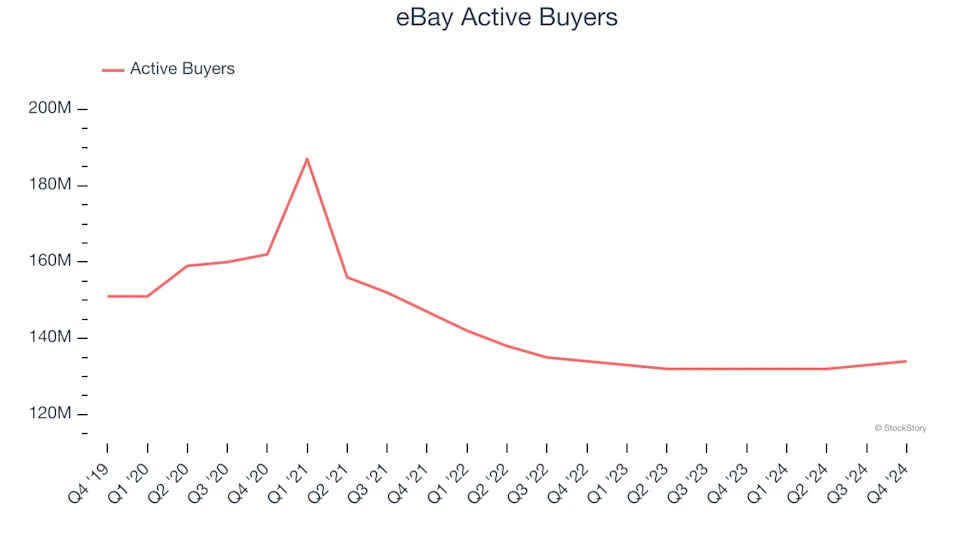

As an online marketplace, eBay generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eBay struggled to engage its audience over the last two years as its active buyers have declined by 1.6% annually to 134 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eBay wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

Luckily, eBay added 2 million active buyers in Q4, leading to 1.5% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating buyer growth.

Revenue Per Buyer

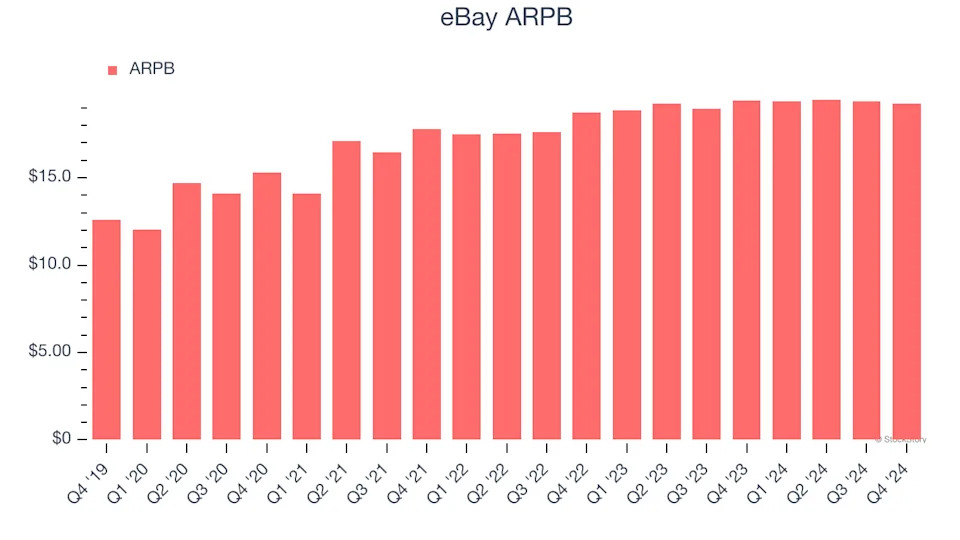

Average revenue per buyer (ARPB) is a critical metric to track for online marketplace businesses like eBay because it measures how much the company earns in transaction fees from each buyer. ARPB also gives us unique insights into a user’s average order size and eBay’s take rate, or "cut", on each order.

eBay’s ARPB growth has been mediocre over the last two years, averaging 4.2%. This raises questions about its platform’s health when paired with its declining active buyers. If eBay wants to grow its buyers, it must either develop new features or lower its monetization of existing ones.

This quarter, eBay’s ARPB clocked in at $19.25. It was flat year on year, worse than the change in its active buyers.

Key Takeaways from eBay’s Q4 Results

We struggled to find many positives in these results. Its revenue guidance for next quarter missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 7.3% to $64.04 immediately after reporting.

eBay’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .