Genetic testing company Natera (NASDAQ:NTRA). reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 53% year on year to $476.1 million. The company’s full-year revenue guidance of $1.91 billion at the midpoint came in 5.8% above analysts’ estimates. Its GAAP loss of $0.41 per share was 9.3% below analysts’ consensus estimates.

Is now the time to buy Natera? Find out in our full research report .

Natera (NTRA) Q4 CY2024 Highlights:

“We had a strong finish to the year, with excellent performance across the board,” said Steve Chapman, chief executive officer of Natera.

Company Overview

Founded in 2004, Natera (NASDAQ:NTRA) provides genetic testing solutions, specializing in non-invasive prenatal testing (NIPT), cancer diagnostics, and organ transplant monitoring to improve patient outcomes and guide clinical decisions.

Immuno-Oncology

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Sales Growth

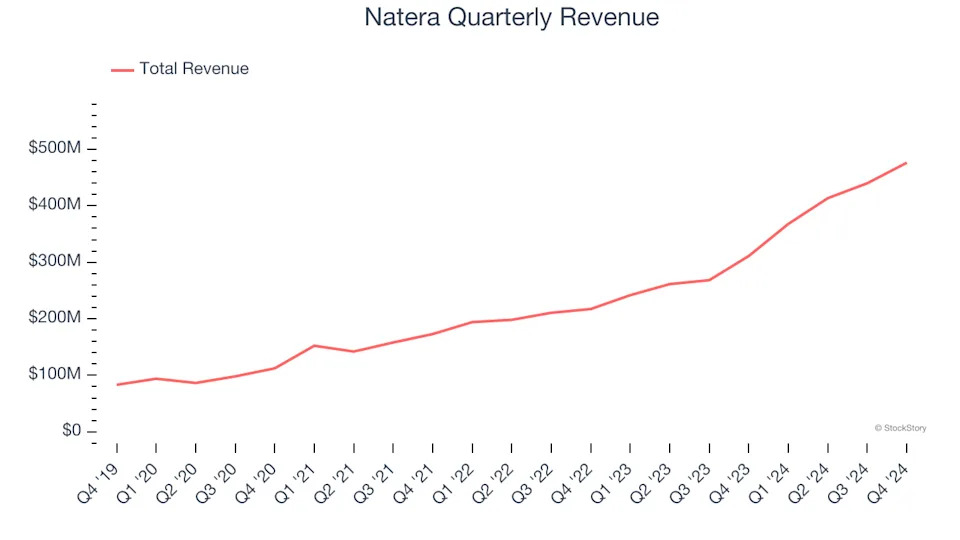

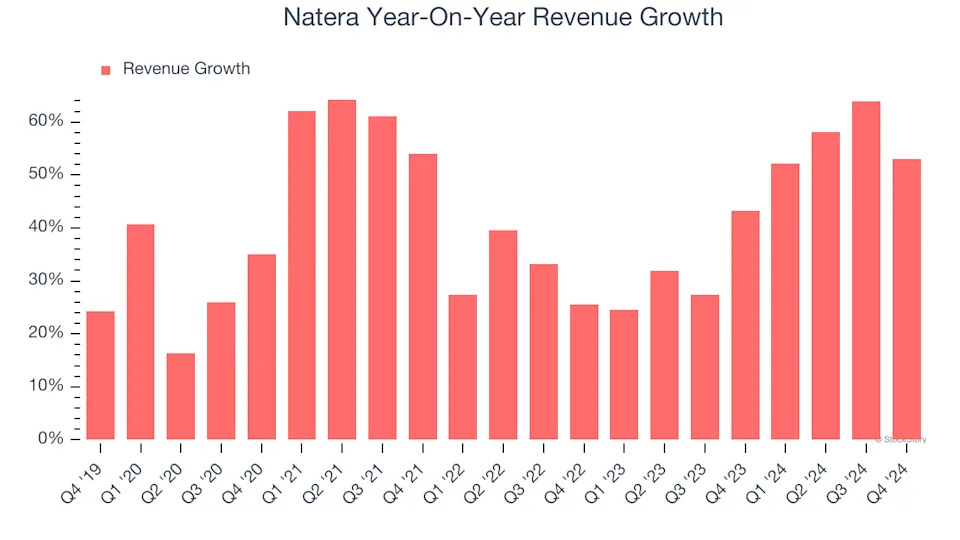

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Natera’s sales grew at an incredible 41.2% compounded annual growth rate over the last five years. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Natera’s annualized revenue growth of 43.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

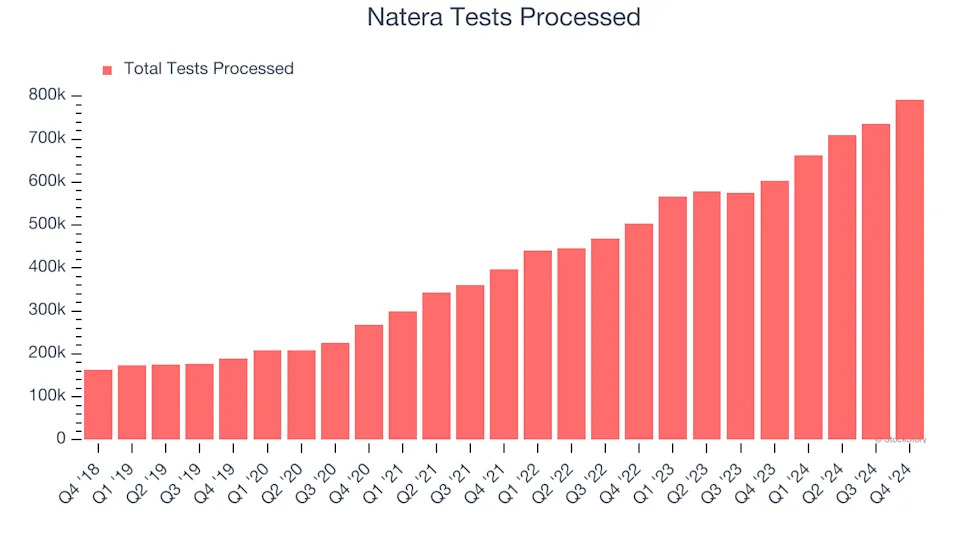

We can better understand the company’s revenue dynamics by analyzing its number of tests processed, which reached 792,800 in the latest quarter. Over the last two years, Natera’s tests processed averaged 24.9% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Natera reported magnificent year-on-year revenue growth of 53%, and its $476.1 million of revenue beat Wall Street’s estimates by 9.9%.

Looking ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and implies the market sees some success for its newer products and services.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

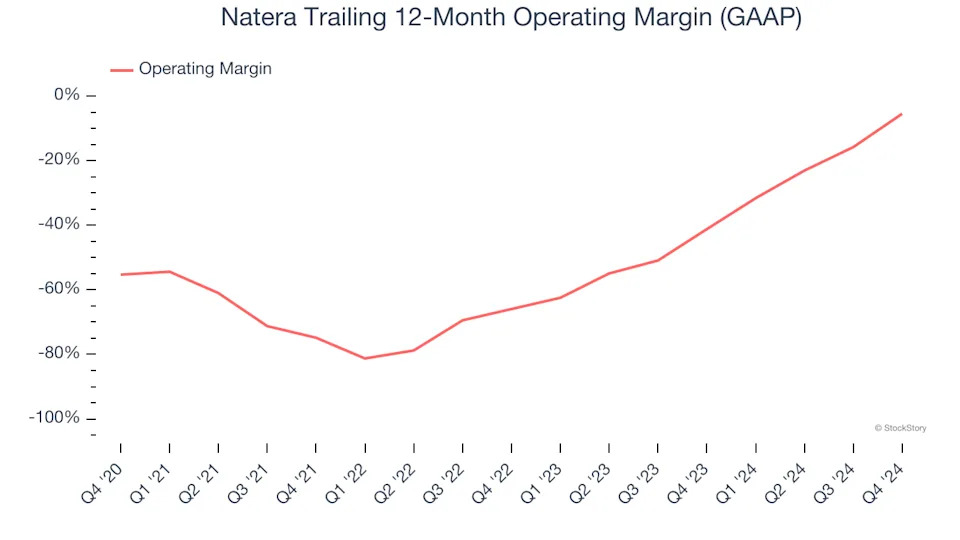

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although Natera was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 38.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Natera’s operating margin rose by 49.8 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 60.5 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

This quarter, Natera generated an operating profit margin of 13.6%, up 40.8 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

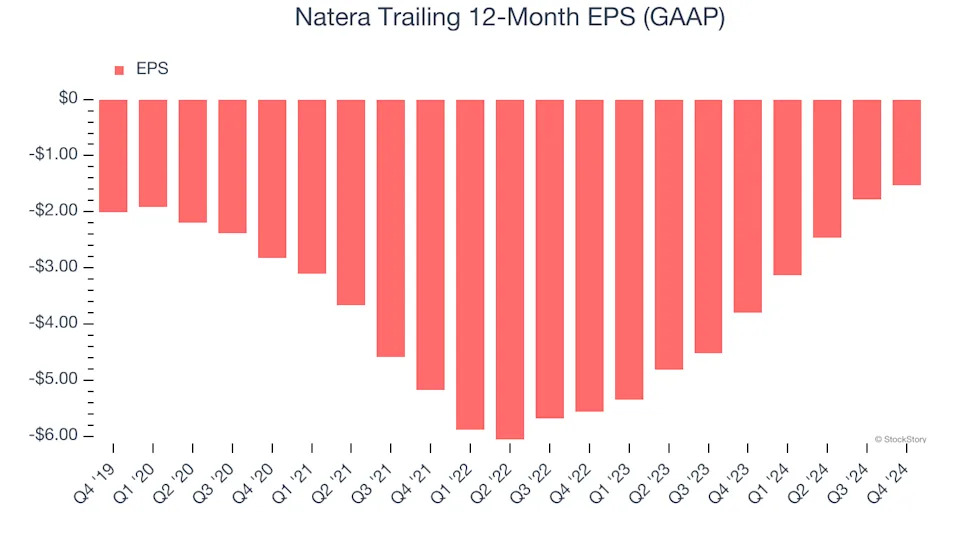

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Natera’s full-year earnings are still negative, it reduced its losses and improved its EPS by 5.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q4, Natera reported EPS at negative $0.41, up from negative $0.65 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Natera to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.53 will advance to negative $1.27.

Key Takeaways from Natera’s Q4 Results

We were impressed by how significantly Natera blew past analysts’ sales volume expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Looking ahead, full-year revenue guidance also exceeded expectations. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $156.76 immediately after reporting.

Natera had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .