The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Procore (NYSE:PCOR) and the rest of the design software stocks fared in Q4.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 6 design software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.8% since the latest earnings results.

Procore (NYSE:PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore (NYSE:PCOR) offers a software-as-service project, finance, and quality management platform for the construction industry.

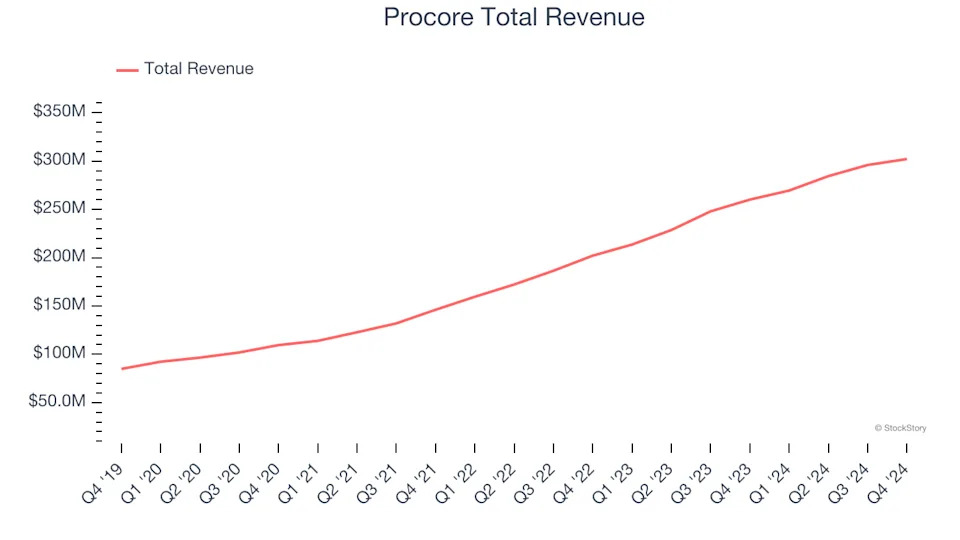

Procore reported revenues of $302 million, up 16.2% year on year. This print exceeded analysts’ expectations by 1.4%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA estimates.

Procore achieved the highest full-year guidance raise of the whole group. The company added 113 customers to reach a total of 17,088. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $74.68.

Is now the time to buy Procore? Access our full analysis of the earnings results here, it’s free .

Best Q4: Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

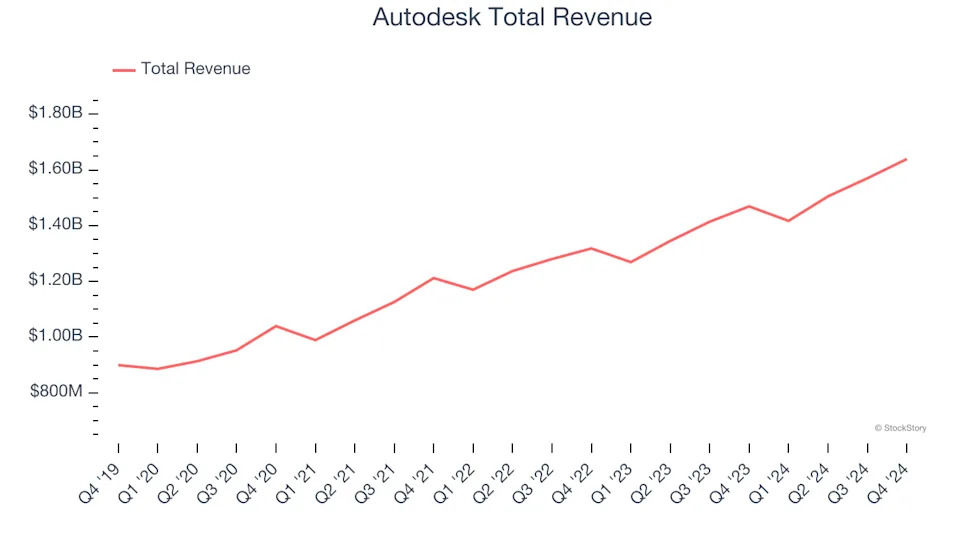

Autodesk reported revenues of $1.64 billion, up 11.6% year on year, in line with analysts’ expectations. The business had a very strong quarter with full-year guidance of accelerating revenue growth and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 5.3% since reporting. It currently trades at $267.43.

Is now the time to buy Autodesk? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $565.1 million, up 2.7% year on year, exceeding analysts’ expectations by 1.9%. Still, it was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

PTC delivered the weakest full-year guidance update in the group. As expected, the stock is down 14.5% since the results and currently trades at $161.99.

Read our full analysis of PTC’s results here.

Cadence (NASDAQ:CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $1.36 billion, up 26.9% year on year. This print met analysts’ expectations. Taking a step back, it was a mixed quarter as it also produced an impressive beat of analysts’ billings estimates but full-year revenue guidance slightly missing analysts’ expectations.

Cadence pulled off the fastest revenue growth among its peers. The stock is down 18.8% since reporting and currently trades at $243.81.

Read our full, actionable report on Cadence here, it’s free.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $457.1 million, down 25% year on year. This number surpassed analysts’ expectations by 5.9%. More broadly, it was a satisfactory quarter as it also recorded a solid beat of analysts’ billings estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Unity delivered the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 17% since reporting and currently trades at $25.16.

Read our full, actionable report on Unity here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .