Internet of Things company Samsara (NYSE:IOT) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 25.3% year on year to $346.3 million. On the other hand, next quarter’s revenue guidance of $351 million was less impressive, coming in 0.6% below analysts’ estimates. Its non-GAAP profit of $0.11 per share was 55.7% above analysts’ consensus estimates.

Is now the time to buy Samsara? Find out in our full research report .

Samsara (IOT) Q4 CY2024 Highlights:

Company Overview

One of the few public companies where Marc Andreessen is a Board member, Samsara (NYSE:IOT) provides software and hardware to track industrial equipment, assets, and fleets.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Sales Growth

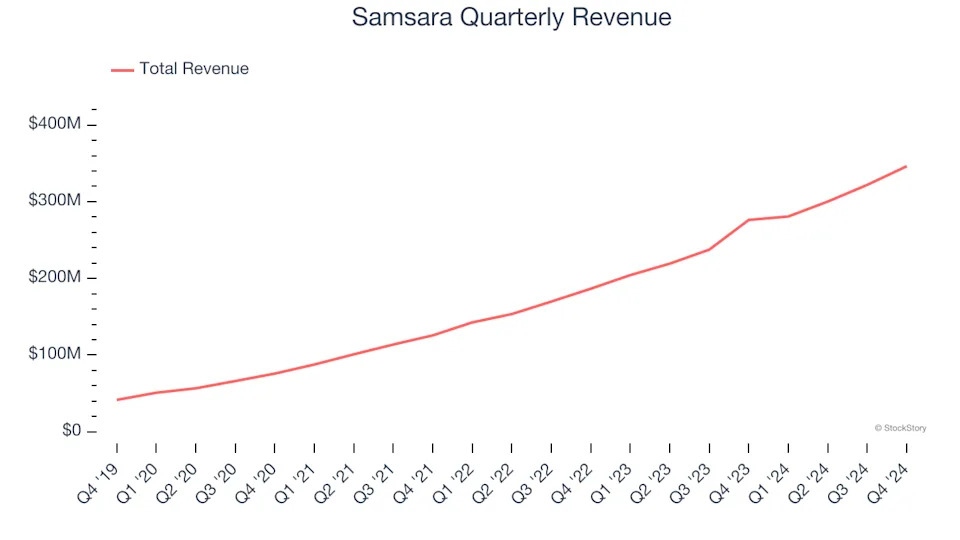

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Samsara’s sales grew at an incredible 42.9% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Samsara reported robust year-on-year revenue growth of 25.3%, and its $346.3 million of revenue topped Wall Street estimates by 2.9%. Company management is currently guiding for a 25% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22.7% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and indicates the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Annual Recurring Revenue

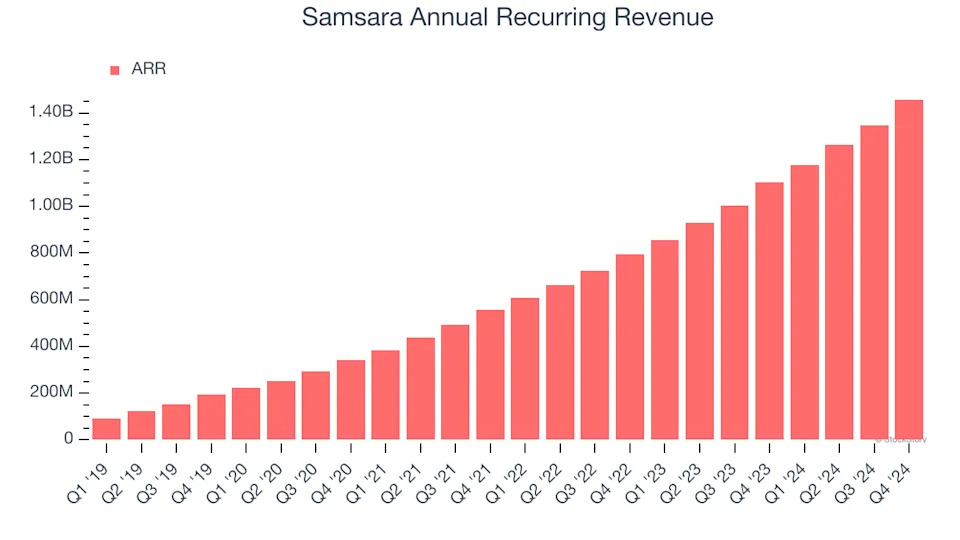

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Samsara’s ARR punched in at $1.46 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 35% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Samsara a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

Enterprise Customer Base

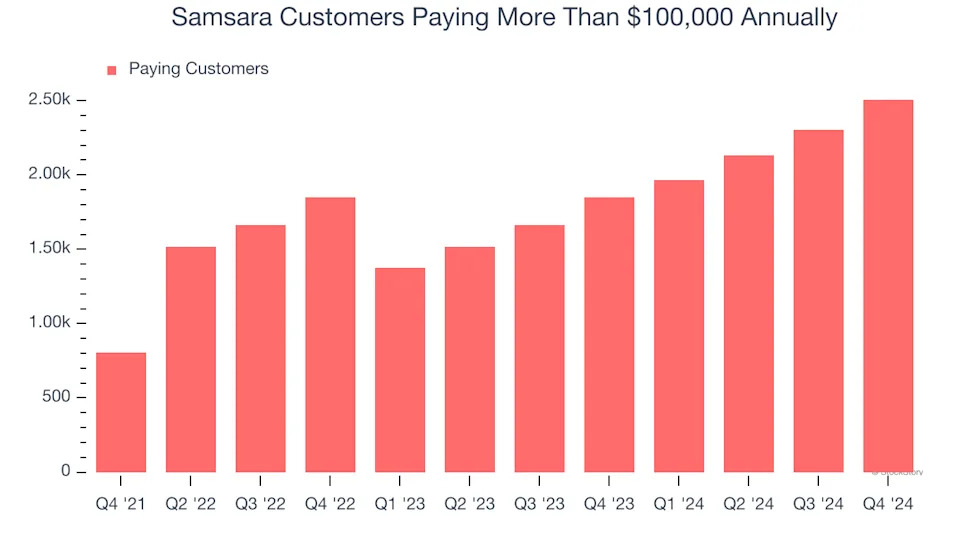

This quarter, Samsara reported 2,506 enterprise customers paying more than $100,000 annually, an increase of 203 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that Samsara’s go-to-market strategy is working well.

Key Takeaways from Samsara’s Q4 Results

We were impressed by Samsara’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also excited that its revenue, EPS, and EBITDA outperformed Wall Street’s estimates. On the other hand, its billings missed and its full-year revenue guidance only met expectations. Overall, this quarter had some key positives, but the stock traded down 13.1% to $36.41 immediately following the results due to the in-line sales forecast (Samsara traded at 17x+ forward revenue going into the print - when companies trade that high, investors expect beats across the board).

Is Samsara an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .