Sporting goods retailer Dick’s Sporting Goods (NYSE:DKS) announced better-than-expected revenue in Q4 CY2024, but sales were flat year on year at $3.89 billion. On the other hand, the company’s full-year revenue guidance of $13.75 billion at the midpoint came in 1% below analysts’ estimates. Its GAAP profit of $3.62 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy Dick's? Find out in our full research report .

Dick's (DKS) Q4 CY2024 Highlights:

Company Overview

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $13.44 billion in revenue over the past 12 months, Dick's is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

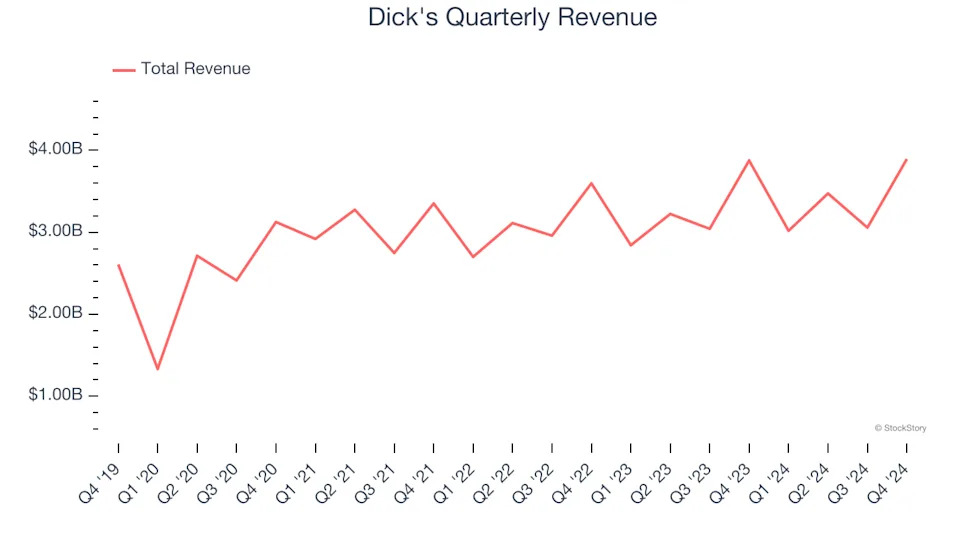

As you can see below, Dick’s sales grew at a mediocre 9% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as its store footprint remained unchanged.

This quarter, Dick’s $3.89 billion of revenue was flat year on year but beat Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is satisfactory given its scale and suggests the market sees success for its products.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

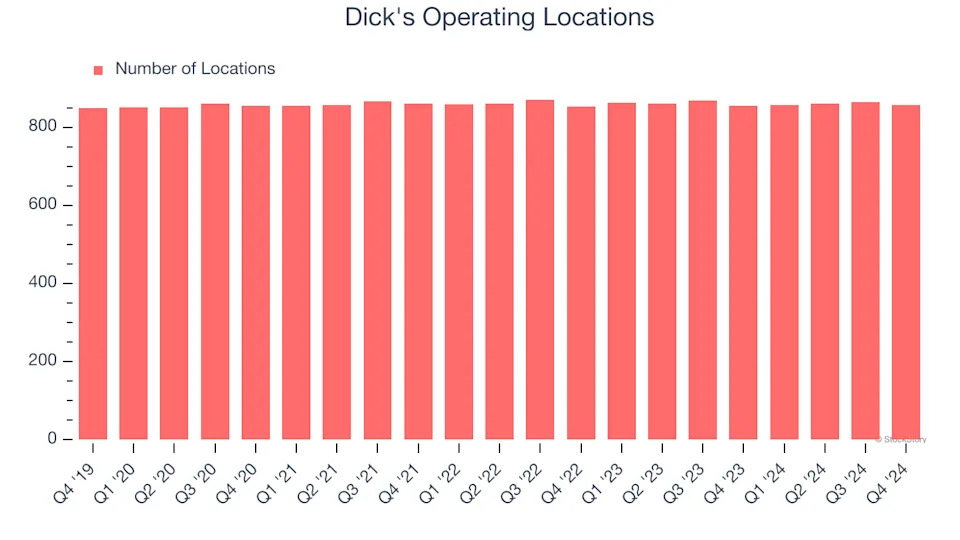

Dick's operated 856 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

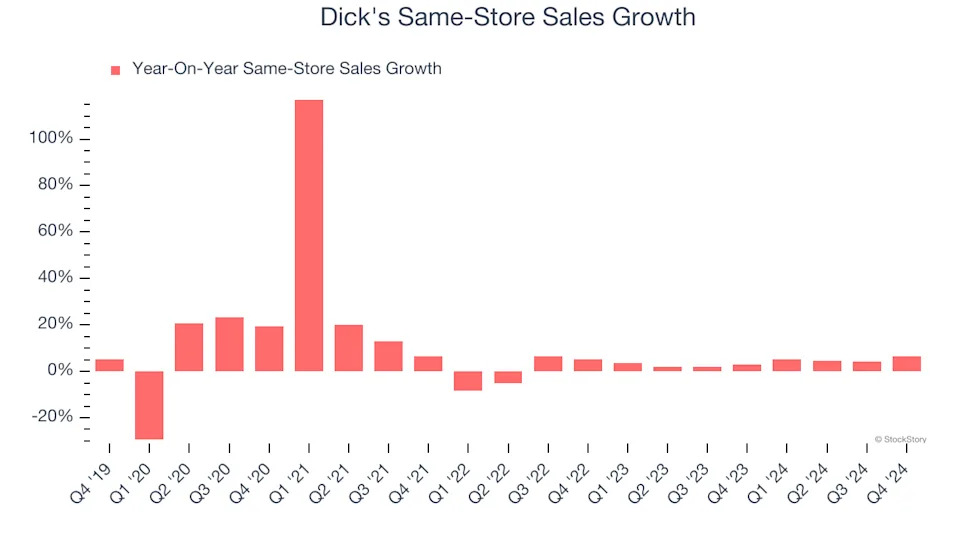

Dick’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.9% per year. Given its flat store base over the same period, this performance stems from not only increased foot traffic at existing locations but also higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, Dick’s same-store sales rose 6.4% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Dick’s Q4 Results

We were glad Dick's revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this quarter was not very good, and shares traded down 5.6% to $199.60 immediately after reporting.

So should you invest in Dick's right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .