Hey there! My name is Nono and I'm a writer for WOLF Financial. If you are looking for more crypto-related content, I guarantee you’ll enjoy my content on 𝕏, @ noahmajor1776 . Thanks for reading!

Although we’ve seen time and time again, smart money piling into Ether while retail has been moving out, it seems as if there is no limit to how low Ether can move. Furthermore, as soon as Ether touched $2,200, it meant that traders and investors that entered the ETH trade all the way back in April of 2021, had only just broken even after 4 years.

There are two fields of thought on this one, either the ETH/BTC ratio is indicating to us that it is time for a generational entry into Ethereum and this is one of the biggest bear traps. A solid Wyckoff accumulation and we could be off to the races. On the other hand, we have the working theory that ETH/BTC is continually headed to zero, and only a few people have truly (deeply) realized this.

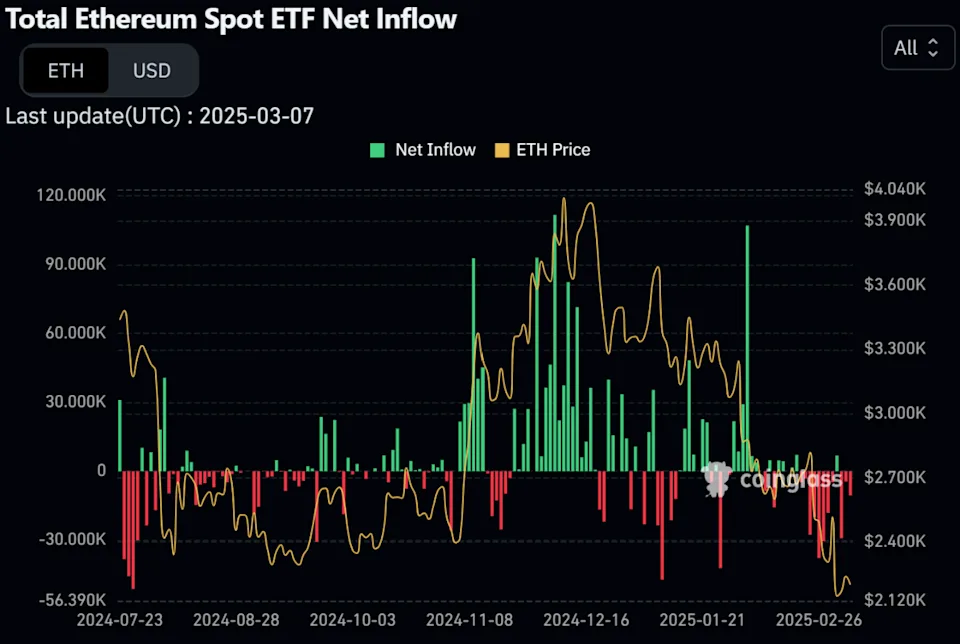

It’s hard to condone or support this second theory when World Liberty Financial, Blackrock, and Fidelity have been scooping up massive amounts of the stuff. The ETF inflows/outflows otherwise look atrocious (unless you’re viewing it as a buying opportunity).

Are we going to learn the hard way this bull market that the ETH-lead altcoin season will never be the same? Or do we just have to be patient, soldier on, act on conviction, and appreciate the opportunity laid out before us?

Ethereum Foundation restructuring, massive lows on ETH/BTC dominance, (satirical or not) takes on Communism by Vitalik, and many other social interactions between the Bitcoin and Ethereum communities have led to some interesting questions. It has also led to crypto enthusiasts repositioning their portfolios to get exposure to the industry in other ways.

If you’re waiting to be an early mover, this may be your time to move as many people seem to be questioning the ability Ether has to ever fully rebound, or touch the dream prices of $5K, $6K, $8K, and eventually $10K.

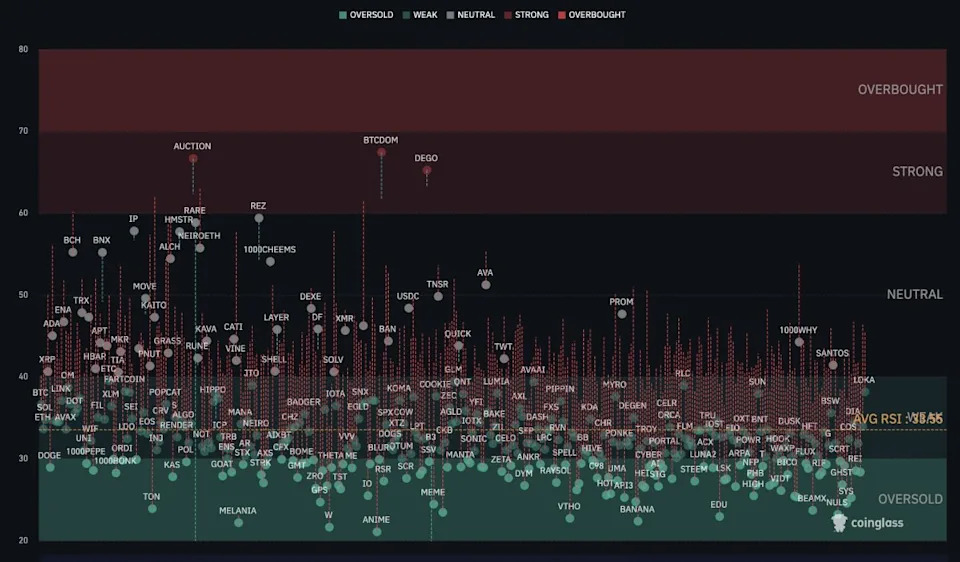

A couple shots of hopium for you here, the entire market was oversold, and as soon as tariff wars play out their full course (and the hopeful lowering rates by Jerome Powell), we might be onto something. While crypto stays tethered to traditional finance, these extreme geopolitical exfoliators that might be good for the long-term growth of the U.S. economy, sure are brutal on altcoins.

Keep your coffee and your wits about you!

V/r,

Nono

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and risky. Always conduct your own research before making any investment decision