Cyber security company SentinelOne (NYSE:S) reported Q4 CY2024 results topping the market’s revenue expectations , with sales up 29.5% year on year to $225.5 million. On the other hand, next quarter’s revenue guidance of $228 million was less impressive, coming in 3.3% below analysts’ estimates. Its non-GAAP profit of $0.04 per share was $0.03 above analysts’ consensus estimates.

Is now the time to buy SentinelOne? Find out in our full research report .

SentinelOne (S) Q4 CY2024 Highlights:

“Our strong finish to the fiscal year reflects solid execution and the accelerating adoption of our platform solutions,” said Tomer Weingarten, CEO of SentinelOne.

Company Overview

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

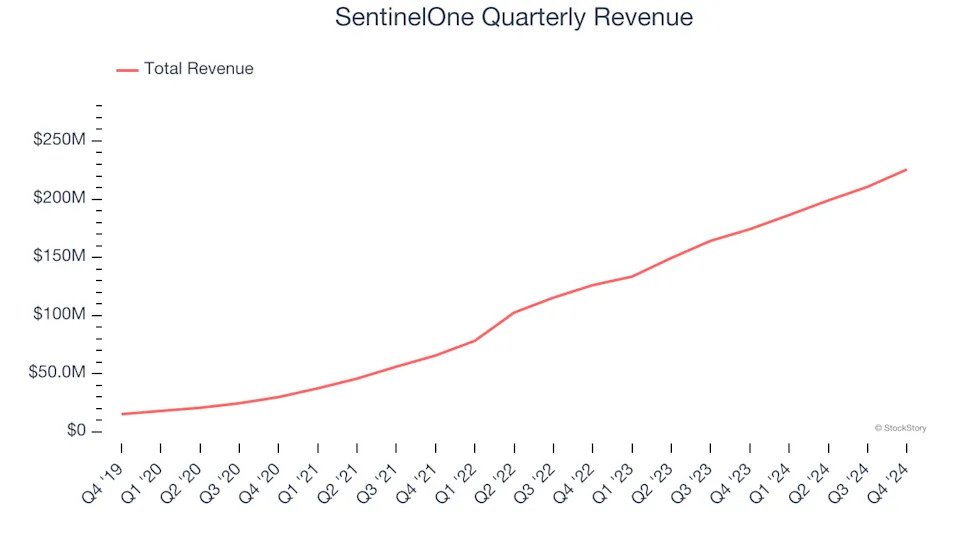

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, SentinelOne’s sales grew at an incredible 58.9% compounded annual growth rate over the last three years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, SentinelOne reported robust year-on-year revenue growth of 29.5%, and its $225.5 million of revenue topped Wall Street estimates by 1.4%. Company management is currently guiding for a 22.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 25.1% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and implies the market is forecasting success for its products and services.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

SentinelOne’s ARR punched in at $920.1 million in Q4, and over the last four quarters, its growth was fantastic as it averaged 30.9% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes SentinelOne a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

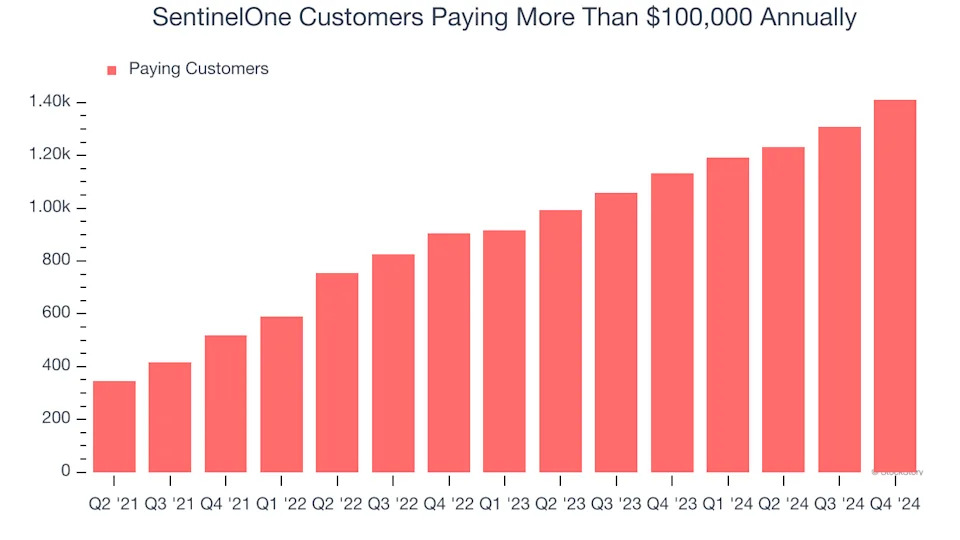

Enterprise Customer Base

This quarter, SentinelOne reported 1,411 enterprise customers paying more than $100,000 annually, an increase of 101 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that SentinelOne’s go-to-market strategy is working well.

Key Takeaways from SentinelOne’s Q4 Results

It was good to see SentinelOne narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance missed significantly, sending the stock down 15% to $16.40 immediately after the report.

The latest quarter from SentinelOne’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .