Let’s dig into the relative performance of Jacobs Solutions (NYSE:J) and its peers as we unravel the now-completed Q3 professional services earnings season.

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled talent and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

The 6 professional services stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 2% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.7% since the latest earnings results.

Jacobs Solutions (NYSE:J)

With a workforce of approximately 45,000 professionals tackling complex challenges from water scarcity to cybersecurity, Jacobs Solutions (NYSE:J) provides engineering, consulting, and technical services focused on infrastructure, sustainability, and advanced technology solutions.

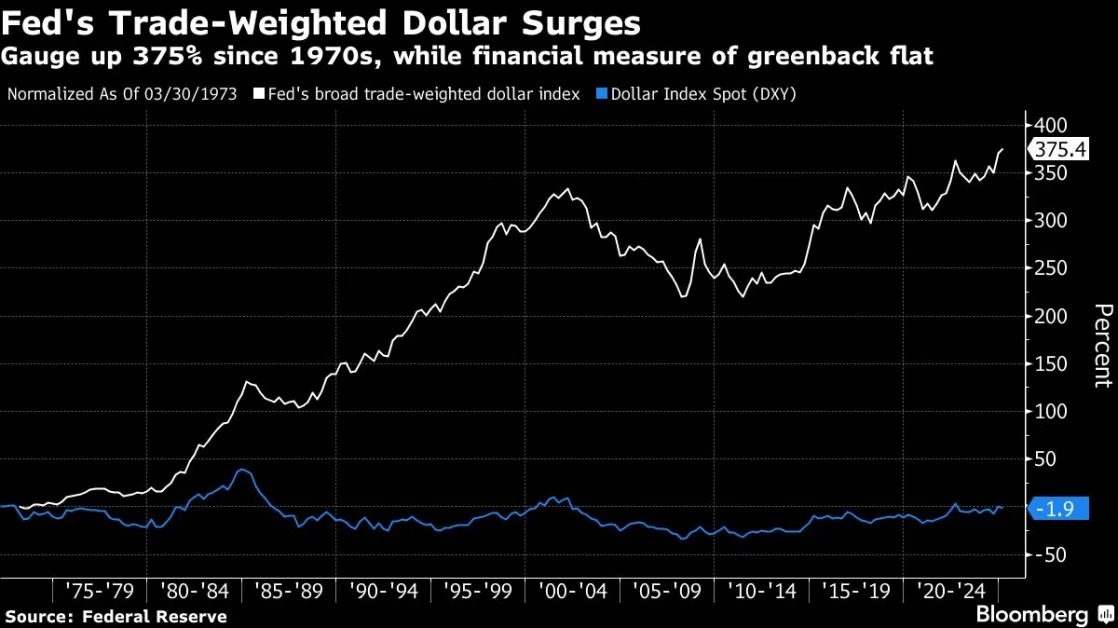

Jacobs Solutions reported revenues of $2.96 billion, up 45.7% year on year. This print fell short of analysts’ expectations by 2.6%. Overall, it was a slower quarter for the company with a significant miss of analysts’ backlog estimates.

Jacobs' Chair and CEO Bob Pragada commented, "Our focus on the transformed portfolio is already having a positive impact on results. We started FY25 with solid performance across our business, led by strong Water and Life Sciences revenue growth within Infrastructure & Advanced Facilities. As we look ahead to the rest of the fiscal year, we continue to see tailwinds from robust bookings over the last several quarters as well as a healthy pipeline across our end markets. We are pleased with our first quarter results and that we've increased our adjusted EPS outlook early in our fiscal year."

The stock is down 12.2% since reporting and currently trades at $121.85.

Read our full report on Jacobs Solutions here, it’s free .

Best Q3: SAIC (NASDAQ:SAIC)

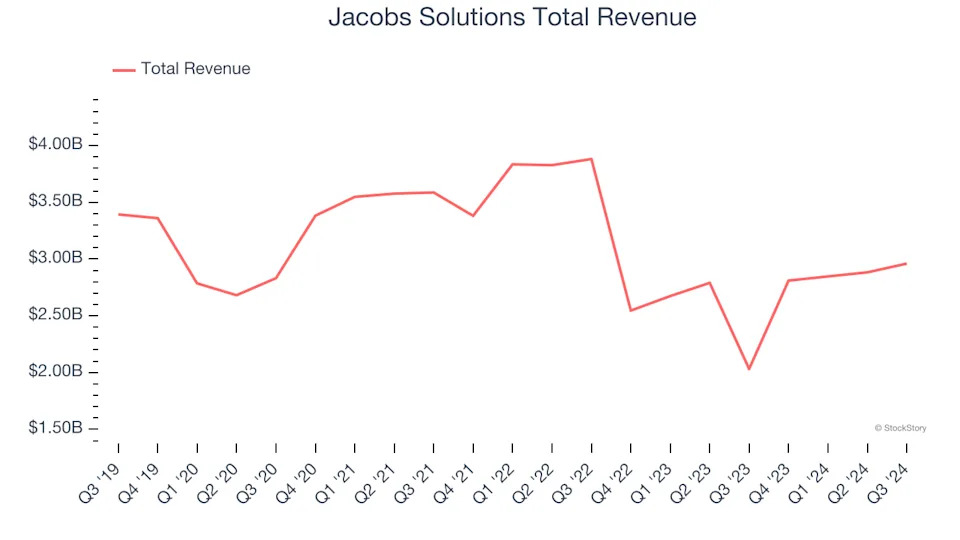

With over five decades of experience supporting national security missions, Science Applications International Corporation (NASDAQ:SAIC) provides technical, engineering, and enterprise IT services primarily to U.S. government agencies and military branches.

SAIC reported revenues of $1.98 billion, up 4.3% year on year, outperforming analysts’ expectations by 2.2%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

SAIC pulled off the highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 14.5% since reporting. It currently trades at $106.

Is now the time to buy SAIC? Access our full analysis of the earnings results here, it’s free .

Weakest Q3: First Advantage (NASDAQ:FA)

Processing approximately 100 million background checks annually across more than 200 countries and territories, First Advantage (NASDAQ:FA) provides employment background screening, identity verification, and compliance solutions to help companies manage hiring risks.

First Advantage reported revenues of $307.1 million, up 51.6% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

First Advantage delivered the fastest revenue growth but had the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 29.4% since the results and currently trades at $13.08.

Read our full analysis of First Advantage’s results here.

Planet Labs (NYSE:PL)

Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE:PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change.

Planet Labs reported revenues of $61.27 million, up 10.6% year on year. This number missed analysts’ expectations by 3.1%. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but revenue guidance for next quarter meeting analysts’ expectations.

The stock is flat since reporting and currently trades at $4.09.

Read our full, actionable report on Planet Labs here, it’s free.

ICF International (NASDAQ:ICFI)

Operating at the intersection of policy, technology, and implementation for over five decades, ICF International (NASDAQ:ICFI) provides professional consulting services and technology solutions to government agencies and commercial clients across energy, health, environment, and security sectors.

ICF International reported revenues of $496.3 million, up 3.8% year on year. This print met analysts’ expectations. It was a very strong quarter as it also logged revenue guidance for the next quarter, exceeding analysts’ expectations and a narrow beat of analysts’ EPS estimates.

The stock is down 15.1% since reporting and currently trades at $84.91.

Read our full, actionable report on ICF International here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .