According to a report published by CoinShares on March 17, the five-week-long outflows accounted for $1.7 billion. The digital assets investment product outflows are also 17 days in a row, the longest such streak on record, with a total outflow of $6.4 billion.

The losses have been severe, but year-to-date inflows remain positive at $912 million. However, due to the continuation of the selling pressure, the digital asset products market has declined by $48 billion in terms of total assets under management (AuM).

The report also points out that the United States saw $1.16 billion of the outflows, accounting over 93% of all outflows. Switzerland saw outflows of $528 million, while Germany was the only country with inflows of $8 million.

Bitcoin leads sell-off

Bitcoin investment products saw the most significant outflows this week, totaling $978 million, which is on top of $5.4 billion in total Bitcoin outflows over the past five weeks.

At the same time, $3.6 million was withdrawn from short Bitcoin products as investors kept leaving these positions.

The report also states that Binance was hit the hardest — an exit of a seed investor wiped out virtually all of Binance's asset under management (AuM), leaving only $15 million AUM.

XRP bucks the trend

In comparison, XRP recorded inflows of $1.8 million. Last week, we also saw outflows of $40 million from blockchain equities, indicating a wider retreat from digital asset investment products.

However, Ethereum and Solana saw $175 million and $2.2 million in outflows, respectively.

Even with Bitcoin rallying to $83,127 recently, the overall outflows may be preventing a breakthrough on the key $85,000 resistance. With investors on a record outflow streak, trend reversal seems on the cards.

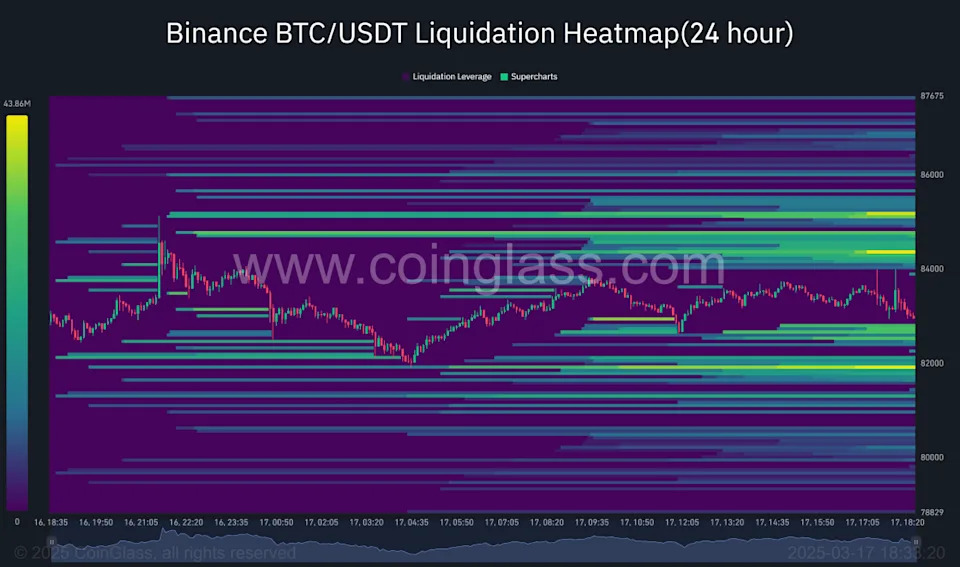

Further, the three-day liquidation heatmap shows major clusters forming around the $84,000 to $85,000 range, indicating a high volume of leveraged trader positions near this resistance point.