General Motors trades at $44.26 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 7.2% while the S&P 500 is down 7.7%. This may have investors wondering how to approach the situation.

Is now the time to buy General Motors, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even though the stock has become cheaper, we're cautious about General Motors. Here are three reasons why we avoid GM and a stock we'd rather own.

Why Is General Motors Not Exciting?

Founded in 1908 by William C. Durant, General Motors (NYSE:GM) offers a range of vehicles and automobiles through brands such as Chevrolet, Buick, GMC, and Cadillac.

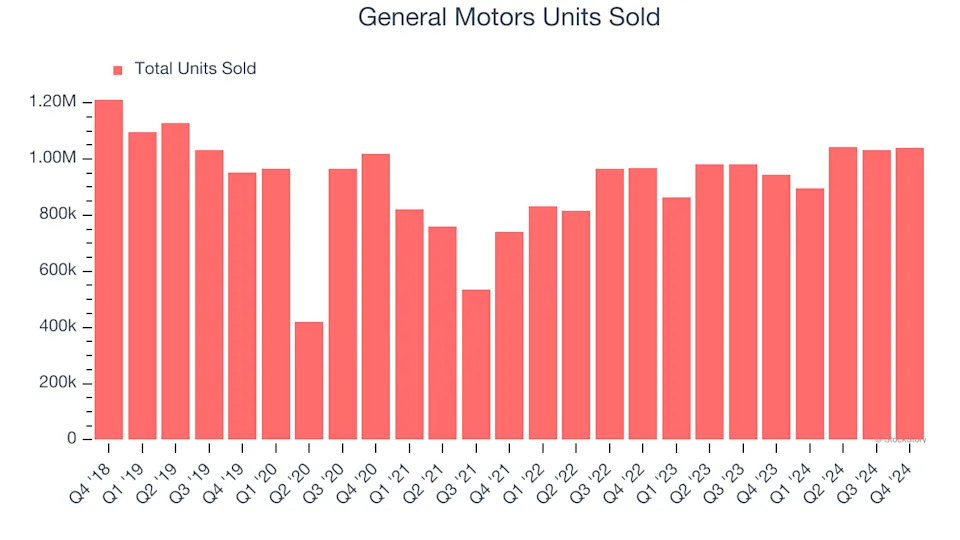

1. Weak Sales Volumes Indicate Waning Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Automobile Manufacturing company because there’s a ceiling to what customers will pay.

General Motors’s units sold came in at 1.04 million in the latest quarter, and over the last two years, averaged 6.1% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect General Motors’s revenue to drop by 3.9%, a decrease from its 9.4% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

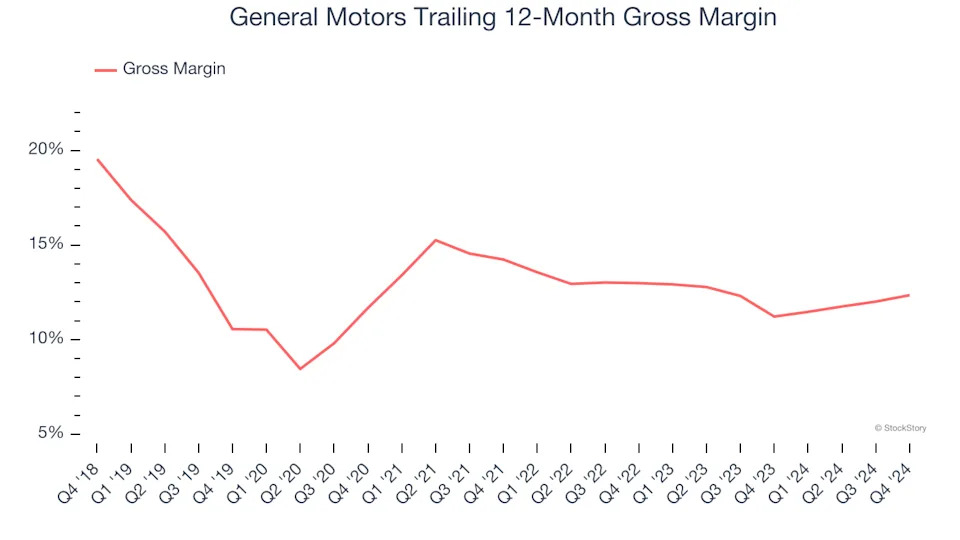

3. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

General Motors has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants such as Rivian, Lucid, and Nikola have negative gross margins. As you can see below, these dynamics culminated in an average 12.4% gross margin for General Motors over the last five years.

Final Judgment

General Motors isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 4.2× forward price-to-earnings (or $44.26 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses .

Stocks We Would Buy Instead of General Motors

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free .