Terex has gotten torched over the last six months - since October 2024, its stock price has dropped 33.6% to $35.28 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Terex, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we don't have much confidence in Terex. Here are three reasons why there are better opportunities than TEX and a stock we'd rather own.

Why Is Terex Not Exciting?

With humble beginnings as a dump truck company, Terex (NYSE:TEX) today manufactures lifting and material handling equipment designed to move and hoist heavy goods and materials.

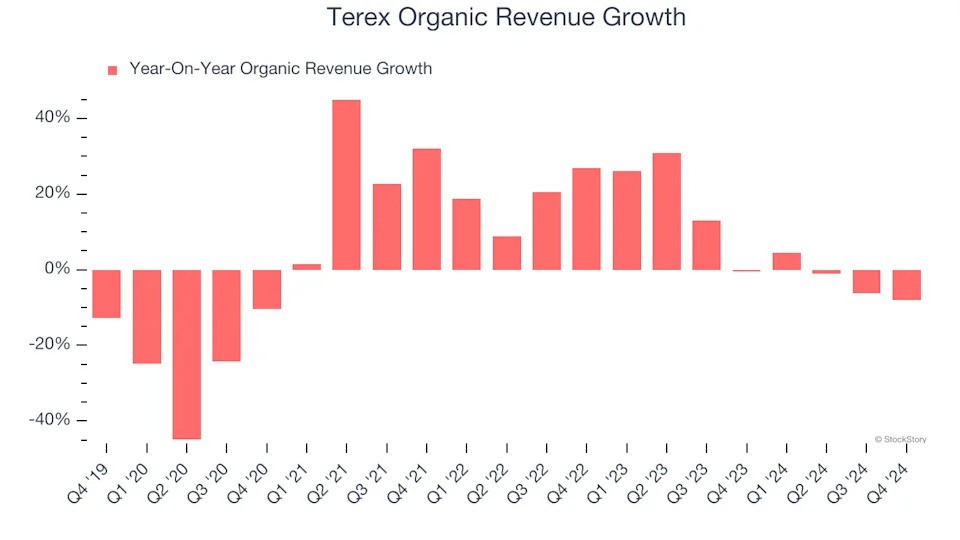

1. Slow Organic Growth Suggests Waning Demand In Core Business

Investors interested in Construction Machinery companies should track organic revenue in addition to reported revenue. This metric gives visibility into Terex’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Terex’s organic revenue averaged 7.3% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Terex’s revenue to rise by 4.8%, a slight deceleration versus its 7.7% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

3. Low Gross Margin Reveals Weak Structural Profitability

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Terex has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 20.4% gross margin over the last five years. That means Terex paid its suppliers a lot of money ($79.63 for every $100 in revenue) to run its business.

Final Judgment

Terex isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 7.4× forward price-to-earnings (or $35.28 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market .

Stocks We Would Buy Instead of Terex

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .