A new survey found investors haven't felt this dour on the economy in decades, another sign of how heavily Donald Trump's trade war is weighing on sentiment .

As part of its weekly Global Fund Manager survey, Bank of America took the pulse of 164 fund managers with $386 billion of assets under management.

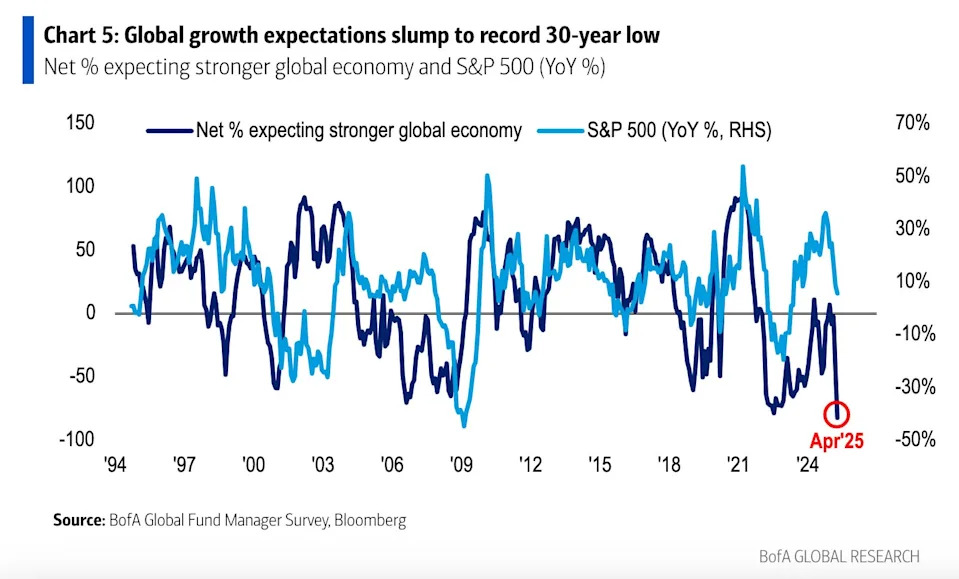

As shown by the dark blue in the chart below, global growth expectations have fallen to a 30-year low. The light blue line shows a similar — though not quite as extreme — decline in S&P 500 expectations.

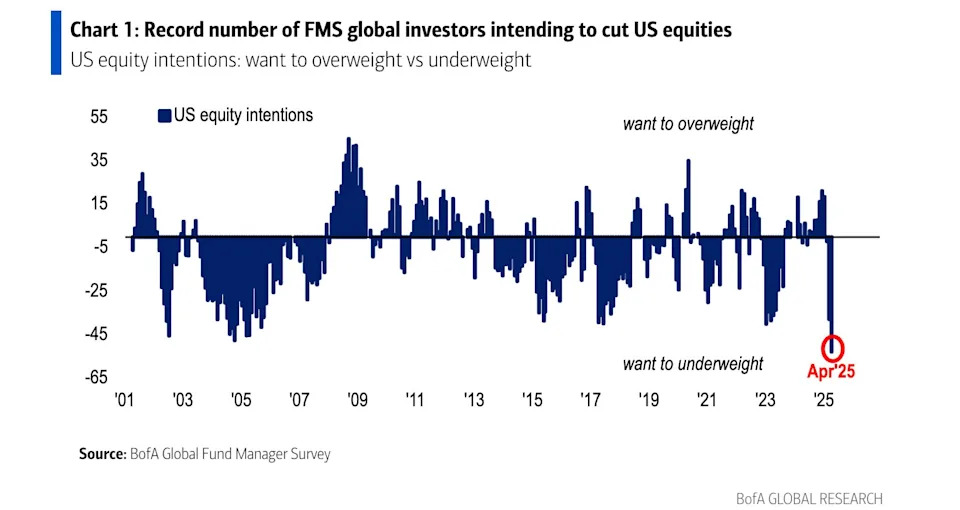

Another chart from the survey illustrated the pessimism around equities, based on the number of participants planning to trim exposure to US stocks, which hit a record low.

The sharp decline in expectations reflects how hard investors have been hit by Trump's April 2 "Liberation Day" tariffs , which helped spark the biggest stock sell-off since the pandemic.

The major indexes have clawed back some of the losses after Trump backtracked and issued a 90-day pause on most of his tariffs. Still, the S&P 500 is down 12% from its peak in mid-February.

Tariffs have worried investors on two fronts. First, markets are antsy about the impact import duties could have on US growth, with chatter about a potential recession making the rounds on Wall Street in recent weeks.

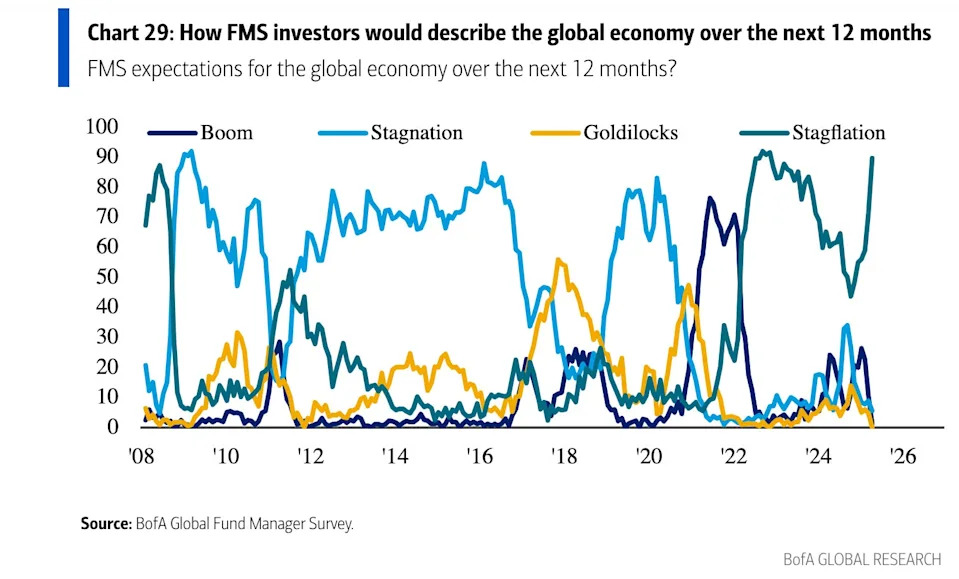

Second, traders are worried about the inflationary impact of tariffs, as companies could pass tariff-related price increases on to consumers. Fears of higher inflation are also raising concerns about stagflation , a nightmare scenario for the economy that involves sluggish growth and stubbornly high prices.

About 80% of fund managers said they believed the biggest tail risk to markets was the trade war triggering a global recession , according to the BofA survey. The share of investors predicting a tail risk hasn't been that large in 15 years, the bank added.

Meanwhile, 90% of fund managers said they expected to see stagflation in the global economy over the next 12 months — the highest stagflation fears have been since 2022.

Trade war pressures don't look like they'll lighten up anytime soon, either. During the 90-day reprieve, the US is negotiating with dozens of countries on trade. Meanwhile, the White House has threatened to impose a 245% tariff on imports from China as tensions escalate between the two nations.

Read the original article on Business Insider