-

The era of central banks is over, Hayes said ahead of an expected Fed rate cut Wednesday.

-

Ethena's USDe and Pendle's BTC staking could benefit from the impending low interest rate regime, Hayes said.

-

Demand for tokenized Treasuries, an interest-rate-sensitive product, could weaken if interest rates remain low.

Arthur Hayes, chief investment officer of Maelstrom and co-founder of BitMEX, has made a bold statement that risk assets, including cryptocurrencies, could crash a few days after the first Fed rate cut, which is expected to be announced on Wednesday.

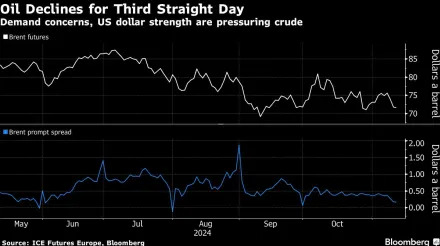

The Fed is expected to announce its first rate cut since 2020 later today, kicking off the so-called liquidity easing cycle that has historically boded well for bitcoin (BTC) .

The impending rate cut, however, would add to the inflation problem and lead to yen (JPY) strength, causing broad-based risk aversion, Hayes explained in an exclusive interview with CoinDesk on the sidelines of the Token2049 conference in Singapore.

"The rate cut is a bad idea because inflation is still an issue in the U.S., with the government being the biggest contributor to the sticky price pressures. If you make borrowing cheaper, it adds to inflation," Hayes said.

"The second reason is that the interest rate differential between the U.S. and Japan narrows with rate cuts. That could lead to sharp appreciation in the yen and trigger unwinding of the yen carry trades," Hayes added.

Markets got a taste of the destabilizing effect of the yen's strength and the resulting unwinding of the yen carry trades in early August after the Bank of Japan raised its benchmark borrowing cost to 0.25% from zero. Bitcoin fell from roughly $64,000 to $50,000 within a week, CoinDesk data show.

USD/JPY is the only thing that matters in the short-term, Hayes said.

Most analysts expect the BOJ to increase rates further in the coming months as the Fed takes the other route. The divergent policy paths mean the yen could rally further, forcing investors to square off long positions in risk assets financed by the JPY-denominated loans.

Hayes sees interest rates in the U.S. falling all the way back to near-zero levels from the current range of 5.25% to 5.5%.

"The initial reaction is going to be negative and the central bank's response will be to do even more [cuts] to stem the crisis. So, I think that cutting rates is a bad idea, but they're going to do it anyway, and so they're going to go to zero quickly," Hayes explained.

Ether bull run ahead

Near zero interest rates mean investors could look for yield elsewhere again, reigniting bull run in yield-bearing pockets of the crypto market like ether, Ethena's USDe and Pendle's BTC staking.

Ether (ETH) , which offers annualized staking yield of 4%, would eventually benefit from ultra-low rates.

Ethena's USDe, which uses BTC and ETH as backing assets, combining them with equal-value short perpetual futures positions to generate yield, and DeFi platform Pendle's BTC staking, which, as of last week, offering a floating yield of 45% stands to benefit as well, Hayes explained.

Meanwhile, demand for tokenized Treasuries, an interest-rate-sensitive product, could weaken.

The era of central banks is over

Over the past couple of years, Scottish market strategist Russel Napier has repeatedly said that advanced nation governments, focused on bringing down debt-to-GDP ratios, have taken control of the money supply, and central banks are fast becoming irrelevant.

Per Napier, governments will resort to targeted liquidity creations in sectors like manufacturing and re-industrialization while keeping inflation elevated.

Hayes believes the same and sees it as a positive development for the crypto market.

"I 100% agree with that prognosis. The era of central banks is over. The politicians are going to take over and tell banks to create liquidity in specific sectors of the economy," Hayes quipped.

"So you're going to see soft and hard capital controls in different locations, which means that, crypto is the only asset that you can own that's globally portable and gets you out of that system," Hayes added.