Donald Trump’s victory in the November elections, the prospect of interest rate cuts and record inflows into U.S. stock markets have put the S&P 500 index on course for a ‘Santa rally’ in the final few trading sessions of 2025, Goldman Sachs’ leading technical strategist has said.

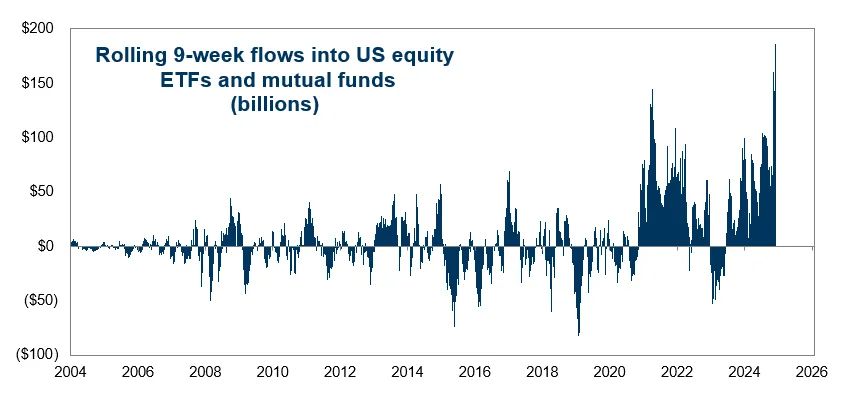

In the past nine weeks, U.S. equity markets have logged a record $186 billion worth of inflows, as capital has flooded into American stocks in the wake of Trump’s electoral win on Nov. 5, Goldman strategist Scott Rubner said in a note.

The record inflows have helped drive up the stock prices of the ‘Magnificent Seven’ technology giants even further, to the extent that the megacap tech companies now account for a record 33% of the S&P 500’s entire market capitalization.

“If you allocate $1 into the S&P 500 ETF into your 401K retirement account, 33 cents get allocated into the top 7 stocks – a record high,” Rubner noted.

The inflows have boosted the value of passively managed assets to heights of $11.773 trillion.

Now, with markets pricing in a 97% likelihood the U.S. Federal Reserve will cut interest rates at its next meeting in December, the S&P 500 index is set for a ‘Santa rally’ for the last trading sessions of 2024, Rubner said.

The S&P 500 SPX index is already up 28% in the year-to-date while the ‘Magnificent Seven’ MAGS are up by 50% over the same period on the back of an impressive run over the last 10 days.

In Rubner’s view, the 2024 rally is now on track to continue into 2025. “My SPX 5K has been retired, my SPX 6K hat is tossed, and my SPX 7K has been ordered,” the Goldman Sachs technical strategist said.

The Goldman strategist said the surge is also likely to be fueled by $1 trillion worth of share buybacks by U.S. corporates, that have already been authorized for 2025. Money flowing into stocks as a result of lower levels of volatility will boost the rally further, he said.