The U.S. stock market may start the new year with a hangover if trouble doesn’t cause headaches before then. Here are three reasons why, and how you should prepare for it.

1. Insiders don’t like this market : An insider sell/buy ratio tracked by Smart Insider was recently at 3.0. That does not bode well for the stock market. “It almost never gets as high as it is now,” Smart Insider head of research Bill Lattimer said in a recent interview. “We consider it bearish when it is over two. The last time insiders were this cautious was in early 2021.” The next year saw a bear market.

The good news is that a lot of the selling is by insiders getting rid of stock into strong price gains. “It is not clear if they think something bad is going to happen in the economy, or they are being opportunistic and taking advantage of higher stock prices,” Lattimer says. The heaviest insider selling currently is in technology, consumer discretionary and bank stocks. Sectors that look the best are pharmaceuticals, biotech and medical equipment.

The bottom line : The stock market can have a hard time moving higher when insiders are so cautious. Their concern may set the market up for a pullback.

2. Investors seem too bullish : Extreme investor bullishness is a negative in the contrarian sense. Most often the crowd gets it wrong, so it pays to bet against them. Being cautious now because of the widespread bullishness is the opposite of being bullish because of extreme negative sentiment.

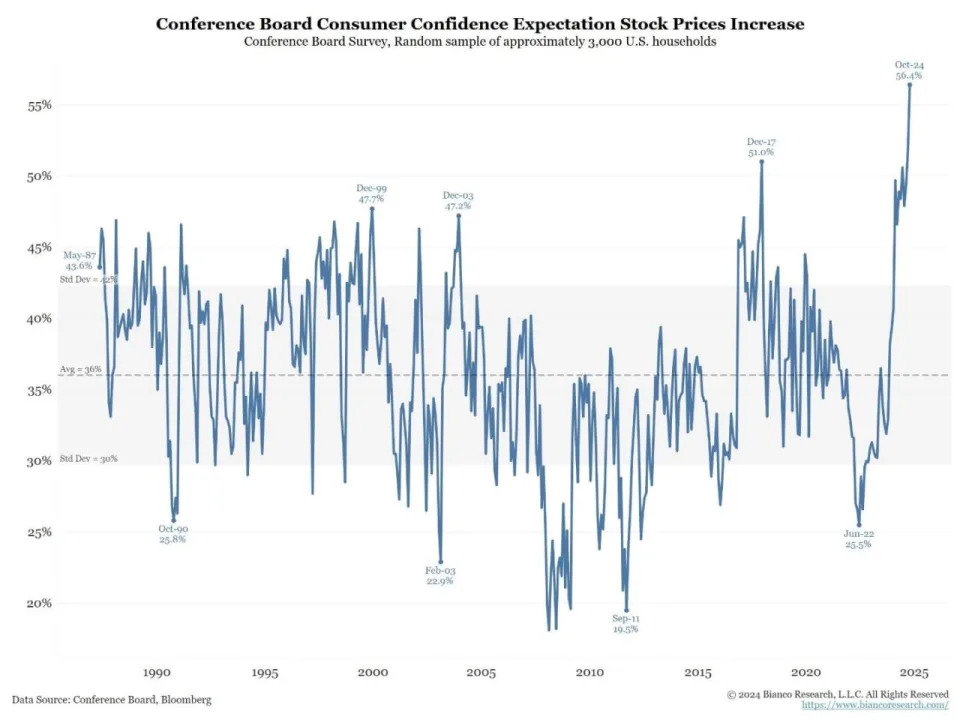

Among the signs of excessive bullishness is a recent Conference Board survey of consumer stock market expectations, which shows 56.4% think the market will go higher from here. Remarkably, consumers are more bullish on stocks now than they have ever been since the 1990s. Here is a chart from Bianco Research.

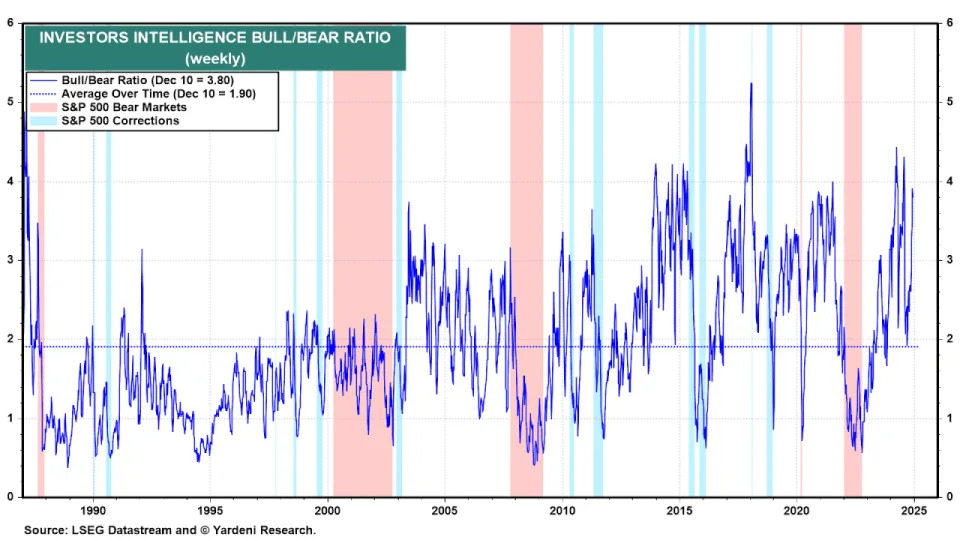

Moreover, the Investors Intelligence Bull/Bear ratio came in at 3.8 this week. Anything near or above 4.0 is a cautious signal, according to how I use this gauge. You can see in the chart below from Yardeni Research that the bull/bear ratio does not normally stay up in the 4.0 zone for long. Often selling ensues, which makes investors more cautious, bringing this ratio down.

This combination of caution among insiders “in the know,” and strong bullishness among “those not in the know,” (the general public) can set the market up for declines, according to George Muzea’s book, “The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses.”

3. Market breadth is narrowing : For the past 10 trading days, decliners have far outpaced advancers on the S&P 500 SPX. You have to go back to 2001 to find a longer stretch of negative market breadth, notes Willie Delwiche, a technical analyst at Hi Mount Research.

Narrowing market breadth can signal trouble for the stock market. In a sense, it means that a pullback has already begun around the edges in most stocks. You just don’t see it in the indices getting propped up by a few big winners. The problem is that this weakness around the edges can spread to embrace most of the market.

Beware January

The three factors above are setting the market up for a pullback. What might trigger it? No one knows. It might be more concerns about inflation.

Another option may simply be the new year. In years with big market gains, like this year, many investors delay selling to push profits and capital gains taxes into the next year. This maneuver can create a rush of selling in the first week or two of the new year. This has happened in the past.

For example, following the 86% Nasdaq COMP gains in 1999, the tech index fell 8.4% in the first four trading days of 2000, before rebounding through March. Following Nasdaq 100 NDX gains of 21.9% in 2015, heavy selling in early 2016 took Nasdaq down 10.8% through January 27. Nasdaq fell 3.3% in the first three days of 2015 and 2024, following strong years.

Those last two examples might seem small. The problem this year is that once the selling starts, it might be compounded by investor complacency — evident in the elevated sentiment metrics I mentioned above. Complacent investors may be caught off guard and “surprised” by the selling, which, in their view was not supposed to happen. Unsure of what is going on, they may sell, too, compounding the declines.

No bear market

The good news is any near-term selling could be fairly brief. Over the past 25 years, the longest stretch of January selling following a strong market year lasted four weeks. More importantly, it’s unlikely this will become a bear market, a 20% or more decline. That’s because the economy is not likely to go into a recession soon. Economist and strategist Jim Paulsen, who writes Paulsen Perspectives on Substack, tells me a recession seems unlikely because none of the traditional vulnerabilities threaten growth.

Meanwhile, U.S. consumer’s balance sheets are strong. Debt-to-income levels are reasonable. Net worth is close to a record high. Consumers have around $7 trillion in money market funds. U.S. unemployment is low and real wages are rising.

On the corporate side, Paulsen sees similar strengths. Net cash flow to GDP is near post-World War II high. Profits continue to rise, and productivity growth is strong. This supports profit growth.

Despite all these positives, consumer confidence is lower than 80% of the time going back to 1952, Paulsen says. The potential for consumer confidence to pick up could act as a catalyst for the economy and stocks.

What to do now

Here are some effective market-hangover cures:

If you are a long-term investor, do not sell to try to dodge a potential near-term selloff. You’d have to get the exit and reentry right. This is difficult.

If you were thinking about taking profits in some stocks, give this more consideration. If you are thinking about entering new positions, take it slow. Consider smaller starter positions, and average in more slowly. Keep cash on hand; you may get better prices ahead. And be careful about owning stocks on margin.

It’s also wise to keep a short list of stocks to consider buying on weakness. Three I’ve recently suggested in my stock letter, based on insider buying and my analysis of the businesses are: MSCI Inc. MSCI in market analytics, Estée Lauder Cos. EL in beauty care, and Truist Financial Corp. TFC bank.

.

More: The bubble in U.S. inflation is likely to burst soon. Here’s why.

Also read: The stock market is up 27% ahead of the final Fed meeting of the year. But is a correction overdue?