It’s the holiday season! We have two consecutive short trading weeks on the way, with Christmas and New Years around the corner. I'm examining the historical data on how stocks tend to perform these weeks. Then I’m going to look at the actual Santa Claus Rally as it was officially defined. Finally, I’ll list some individual stocks to keep an eye on during the most wonderful time of the year.

SPX Returns for Holiday Weeks

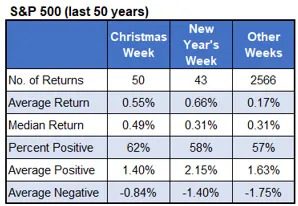

The table below summarizes weekly returns for the S&P 500 Index (SPX) over the past 50 years. Certain years, traders don’t get a day off for New Year’s so that’s why there’s less than 50 New Year’s weeks. Buyers seem to stick around on the holidays as these have been bullish weeks for stocks. The SPX averages a 0.55% return during the week of Christmas with 62% of the returns positive. New Year’s has done even better averaging a return of 0.66%. These holiday weeks easily beat the typical weekly return for the SPX of 0.17%.

What to Expect for a Santa Claus Rally

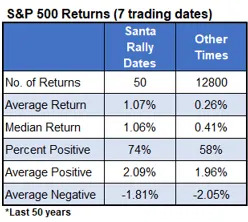

The general outperformance for stocks at the end of year is often casually referred to as the Santa Claus Rally. According to Investopedia, however, the term was first used in 1972 by Yale Hirsch, the founder of the Stock Trader’s Almanac. He defined the Santa Claus Rally as the first two trading days of the New Year along with the last five trading days of the previous year. So, let’s look at how these specific seven trading days have performed over the past 50 years.

This has indeed been a bullish time. The S&P 500 has averaged a return of more than 1% with positive returns 74% of the time during these seven trading days. The typical 7-day return for the index was 0.26% with 58% of the returns positive.

Individual Stock Performance

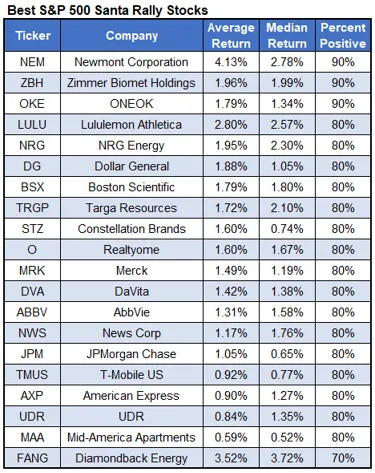

This next table lists the S&P 500 stocks which have performed the best during the Santa Claus Rally over the past 10 years (sorted by percent positive then average return). Newmont (NEM) tops the list averaging a return of more than 4% with 90% of the returns positive. I see a few real estate names and healthcare companies, but no sector is dominating the list.

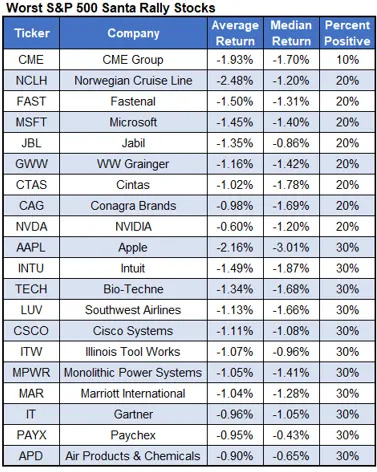

Finally, there have been stocks that underperform during this time. This next table shows the worst performing S&P 500 stocks during the Santa Claus Rally timeframe. CME Group (CME) tops this list, finishing positive just one time out of 10 during these seven trading days. Interestingly, some mega-cap stocks show up on this list including Microsoft (MSFT), Nvidia (NVDA), and Apple (AAPL). A decent number of information technology companies have performed poorly showing up in the table below.