More than a decade after FANG became a popular way of grouping top-performing technology stocks, there’s a new acronym in town.

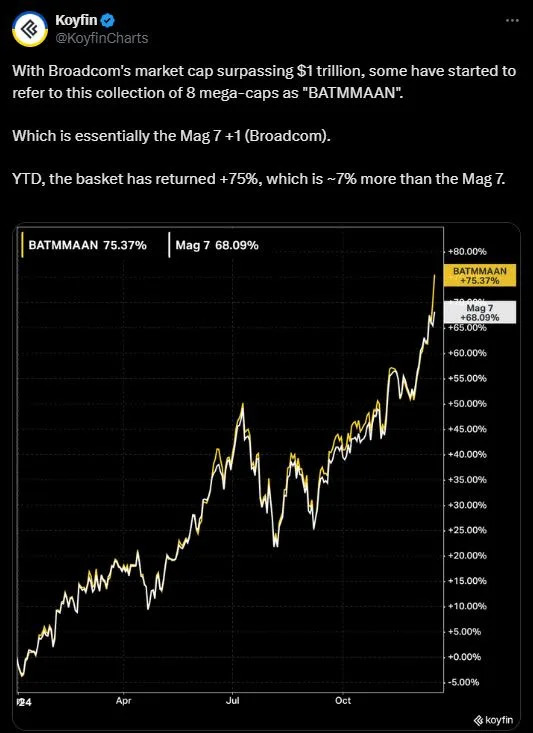

Enter BATMMAAN, a term that has been making the rounds since another potential tech kingmaker — Broadcom — began closing in on the $1 trillion market cap club last week. The grouping is as follows: Broadcom AVGO , Apple AAPL, Tesla TSLA, Microsoft MSFT, Meta Platforms META , Amazon.com AMZN, Alphabet GOOGL and Nvidia NVDA. In other words, the “Magnificent 8.”

While CNBC’s Jim Cramer was credited with the original FANG acronym (Facebook, which became Meta, Amazon, Neflix and Alphabet), origins of the newest grouping aren’t that clear, but the investing world is picking up fast as ANTMAMA (the “Magnificent 7” minus Broadcom) gets replaced:

Shares of artificial intelligence chip maker Broadcom, whose market capitalization is now up to $1.12 trillion, have been hoofing it higher after reporting earnings last week in which executives forecast booming AI sales . That outlook helped sparked the biggest ever one-day percentage gain for the stock of 24% in the following session.

Many have been calling that Broadcom’s “Nvidia moment”, in reference to 2023, when the latter’s blowout results sent investors scrambling into the stock. Since that moment, Nvidia shares, even amid bouts of selling, have climbed 243%.

Read: Nvidia’s stock may have lost its luster, but the rest of tech can still shine

Hedge funds, appear to be piling into Broadcom, according to an analysis of monthly holdings from Your Weekend Reading that showed the chip maker at No. 8 among top equity positions at 338 hedge funds as of Dec. 16, becoming a top holding after not even being on that list earlier this year.

Year-to-date, Nvidia remains the biggest driver of BATMAANN gains, up 163%, followed by Broadcom’s late-year surge to 115%, then 93% for Tesla, 75% for Meta, 52% for Amazon.com, 39% for Alphabet 31% for Apple and 20% for Microsoft, which incidentally is the top holding among hedge funds.

Read: Nvidia stock is in a correction. Microsoft’s CEO may have just said something very worrying.

And for Wall Steet, tech stock dominance may remain the only game in town for 2025. Bank of America’s December global fund managers survey reported that being Long “Magnificent 7” continues to be the most crowded trade — 21 months and counting.

In a separate note to clients, the bank’s strategists said that a market bust for the big tech stocks was now unavoidable, but they would likely continue outperforming in 2025.

“Not owning enough U.S. stocks or large-cap stocks or tech stocks has been a painful stance for many years, and we think it’s still a major risk in 2025,” said a team led by Benjamin Bowler.

Read: This could be the ‘next big thing’ for the stock market after generative AI

And: This hot AI stock is set to harness huge opportunity as ‘demand mojo’ plays out