(Bloomberg) -- Bond-market veteran Bob Michele says there’s one scenario investors aren’t fully prepared for in 2025: the calmest Treasury market in nearly a decade.

JPMorgan Asset Management’s chief investment officer for global fixed income, currencies and commodities sees a chance that yields trade in the narrowest range in eight years, while the Federal Reserve does little to alter its policy rate next year. On Wednesday markets were jolted — with yields surging — by what many deemed as a more hawkish signal from policymakers at the end of a two-day meeting.

According to the money manager, who began his Wall Street career during the stagflation crisis of the early 1980s, the market is not currently pricing in such a trajectory. It’s not necessarily his base case, but one of five “realistic surprise predictions,” which Michele says have at least a one-in-three likelihood of occurring over the next 12 months.

“The markets are all wound up about policy that’s going to come out of Washington, talking about sequencing on taxes, immigration, deregulation and tariffs,” Michele said in an interview Wednesday. “But the reality is it’s just going to take time to pass all of this. You’re really looking at a year out and I think the market will tread water over this period.”

Such a period of tranquility could come as the Fed finds itself “not having to do much at all,” according to Michele, who sees the US central bank ultimately bringing the fed funds rate down to a range of 3.75% to 4%.

The Fed cut its monetary policy rate on Wednesday by a quarter point, moving it to a range of 4.25% to 4.50%, bringing reductions to a full percentage point over the course of this year. But in a more hawkish move than markets expected, policymakers slashed the median forecast for 2025 to two cuts from the four indicated in September. Fed Chair Jerome Powell, in his post-meeting discussion with reporters, signaled the central bank was in a new phase and would be cutting rates more cautiously going forward.

Michele’s call for a soft landing for the US economy still stands, he told Bloomberg News before the decision, something he’s been saying for months.

If calm prevails in the year ahead, Michele said, the 10-year yield likely will trade in a range of 3.9% to 4.65%.

Michele follows a now hallowed tradition on Wall Street, prognosticating on less-likely scenarios that investors aren’t fully prepared for with the potential to rock markets.

“In our process we spend a lot of time trying to come up with a base case scenario,” he said. “But having an understanding of reasonable tail risks, to me, is also a good part of an investment process.”

Emerging Rally

After taking a beating in the wake of Donald Trump’s presidential win, emerging-market securities could make a roaring comeback next year.

Should the worst-case scenarios investors now fear not pan out, double-digit returns on both EM debt and currencies in some regions are possible, according to Michele.

“If it turns out that the tariffs which are now widely talked about at being at levels of 25% to 60%, in reality start at a couple percent and then are raised — and don’t get anywhere near those fear levels,” then some markets are really oversold, he said.

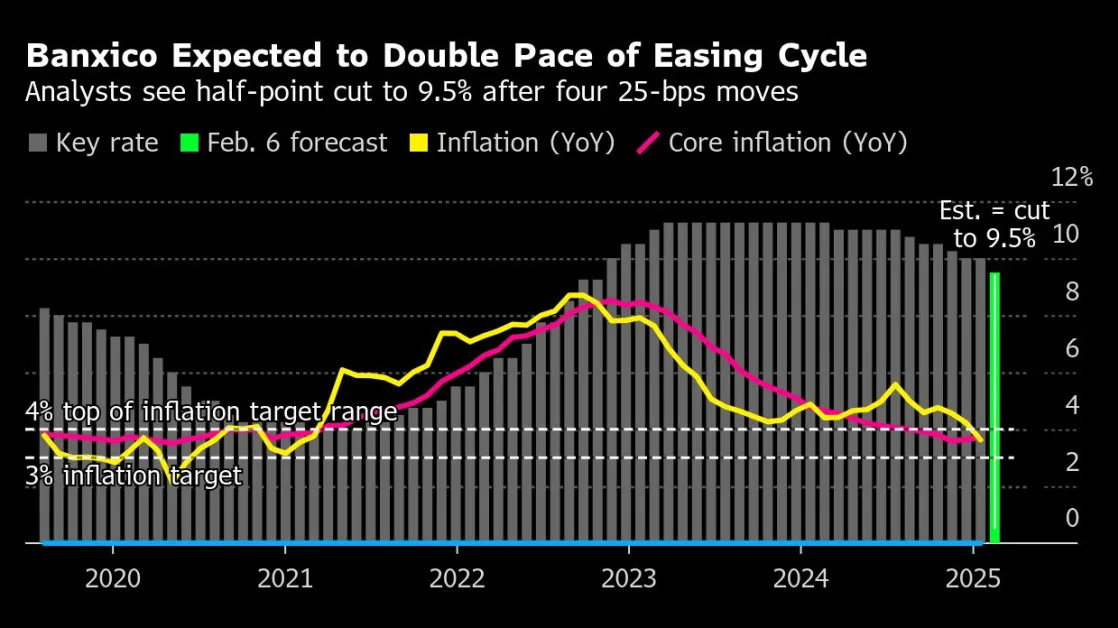

Heavy hitters, like Mexico, where the local debt yields 10% and the currency trades at over 20 pesos per dollar, are “vulnerable to a significant rally.”

Crude Shock

The President-elect’s call to “drill, baby, drill,” paired with plans from Scott Bessent, Trump’s pick for Treasury Secretary, to increase US oil production by 3 million barrels a day could overwhelm the oil market, he said. That could send West Texas intermediate crude oil plunging below $50 a barrel.

Crude currently trades around $70 a barrel.

Also possible, Michele said, US high-yield bonds outperform their investment-grade counterparts for the fifth consecutive year, especially given the low odds of a recession.

Sovereign Spreads

Michele is keeping a potential shock in sovereign bond spreads on his radar. Specifically, the gap between France and Italy’s yields may collapse to zero as would that between Germany and Japan’s government debt.

“Italy has improved its fiscal trajectory” over the last decade, Michele said in his report. “France, on the other hand, is struggling with political turmoil and concerns over excess borrowing and spending.” The yield on Italy’s 10-year note is now about 36 basis points more than similar maturities in France.

The prediction comes even as some spreads expand, for example: UK government borrowing costs reached the highest level in decades relative to Germany this week.

Currently, Germany’s 10-year rate is about 124 basis points greater than its counterpart in Japan.

“Germany continues to struggle with lackluster growth in its export-oriented economy,” Michele wrote. “With the Bank of Japan poised to deliver more rate hikes, it is also possible that the ECB is forced to cut rates more quickly.”

--With assistance from Ye Xie.