Indexes on Thursday rose after a steep sell-off in Wednesday's session following the Federal Reserve's last policy meeting of the year.

The Dow Jones Industrial Average was aiming to break a 10-day losing streak, its worst since 1974. The index was up over 300 points at the open after it shed 1,123 points in Wednesday's session.

The S&P 500 and the Nasdaq also rebounded, up 0.72% and 1% respectively.

The rebound follows the Fed meeting, which resulted in a 25 basis point rate cut, but also signaled less easing ahead in 2025.

The central bank indicated fewer rate cuts for next year than previously expected, signaling it will likely only cut rates twice in 2025, down from the four cuts it had projected in its last forecast in September.

Fed Chair Jerome Powell stressed the importance of continuing to bring down inflation, which has remained sticky in recent months.

He noted that Wednesday's rate will allow the Fed to be more cautious in 2025. The central bank's easing cycle kicked off in September.

"With today's action, we have lowered our policy rate by a full percentage point from its peak, and our policy stance is now significantly less restrictive. We can therefore be more cautious as we consider further adjustments to our policy rate," Powell said in prepared remarks Wednesday afternoon.

After the Fed's cut and adjusted outlook, the Cboe Volatility Index jumped amid increased uncertainty, and the 10-year Treasury yield rose.

Here's where US indexes stood shortly after the 9:30 a.m. opening bell on Thursday:

Here's what else is happening:

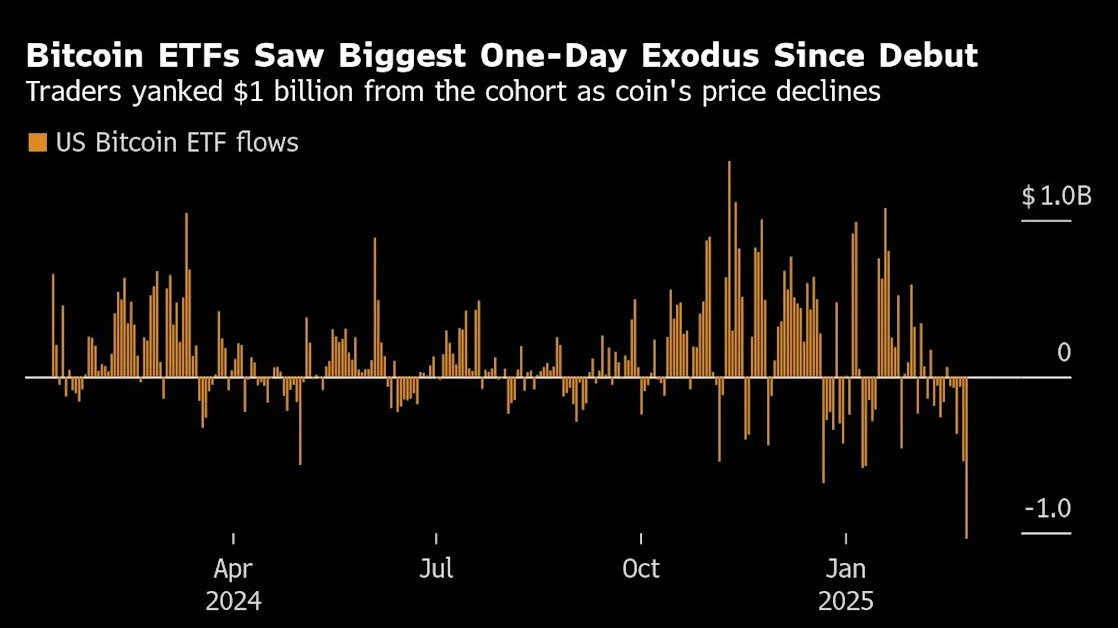

In commodities, bonds, and crypto:

Read the original article on Business Insider