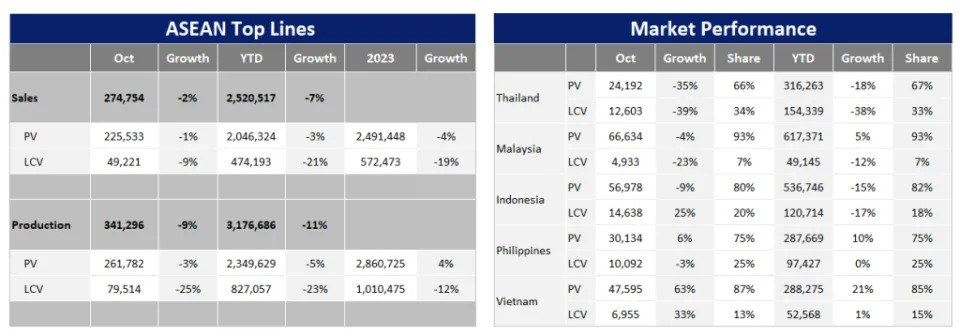

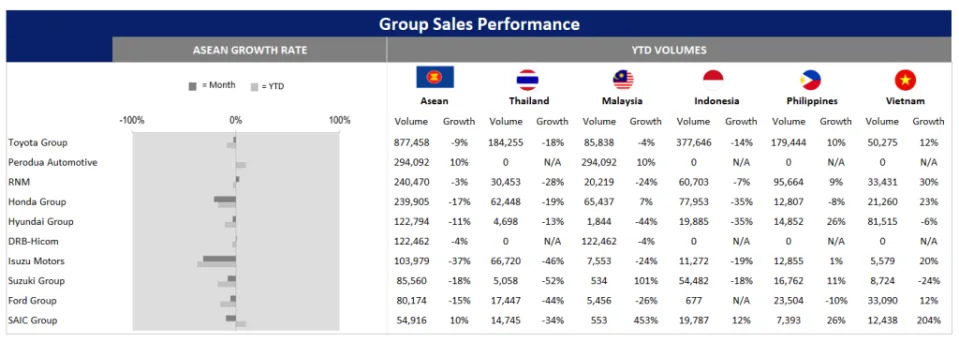

The ASEAN Light Vehicle (LV) market declined by 2% year-on-year (YoY) in October 2024 and 7% YoY from January to October as a whole. For November, regional LV sales were estimated to have declined by 5% YoY, as our advanced data indicated negative results in the three largest markets: Malaysia, Indonesia, and Thailand.

Nevertheless, the 2024 sales outlook has been slightly increased from 3.04 million units to 3.06 million units, due to upward projections in Vietnam and Indonesia.

The Vietnamese LV market experienced robust growth for the second consecutive month in October, bolstered by the reintroduction of the temporary registration fee reduction program. The monthly sales rate soared to 607k units/year, marking an 11% increase from a strong September and the highest rate since May 2022. Consequently, the year-to-date (YTD) average sales rate climbed to 422k units/year. In YoY terms, volumes in October surged by 58%, following a 51% rise in September and a 17% increase across the first ten months of the year as a whole, compared to the same period in 2023, which had notably low levels.

It is important to note that the government reinstated the 50% registration fee reduction program from September 1 to November 30, exclusively for domestically manufactured vehicles. This incentive program has been implemented several times previously. During its last iteration in the latter half of 2023, the program did not significantly boost sales, as the country was contending with a property crisis. However, this time, there seems to be a greater willingness to take advantage of the scheme, driven by an improving economic climate. As the policy could propel demand to be stronger than our expectations, and since November sales were expected to be robust with the policy ending in the month, Vietnam’s 2024 sales forecast has been raised from 412k units to 434k units (+14% YoY).

According to the recent GAIKINDO report, Indonesia’s LV sales continued to drop by 12% YoY and 5% month-on-month (MoM) in November. The month’s selling rate is estimated to be 773k units/year, almost unchanged from a sluggish October. Meanwhile, the YTD selling rate averaged only 789k units/year, compared to the pre-pandemic high of 1 million units.

Despite November volumes being weaker than expected, the 2024 sales forecast has been raised slightly from 792k units to 798k units. This adjustment is due to the government’s decision to proceed with the VAT hike (from 11% to 12%) for most goods, including vehicles, effective January 1, 2025. As such, it is anticipated that buyers will rush to make purchases in December 2024 before the price increases.

In contrast, the 2024 sales projections for the Philippines, Thailand, and Malaysia have been slightly reduced.

LV sales in the Philippines increased by 7% YoY from January to October, marking a slowdown from 11% YoY in Q1 2024 and 9% YoY in H1 2024. The expansion through October was supported by a catch-up in supply, backlogged orders, and recent new model launches, particularly the entry of new inexpensive Chinese Internal Combustion Engine (ICE) models. With imports accounting for 80% of new vehicle purchases, the increased global supply of new vehicles boosted sales in the country. October volumes were in line with our expectations, but the 2024 sales outlook has been marginally lowered to 461k units, which is still a record high. This adjustment results from the expectation that natural disasters would disrupt sales activity. The Philippines faced six major typhoons between the end of October and mid-November, breaking a new record.

The Thai LV market is poised for its most challenging sales year, marking one of the most significant downturns since the global financial crisis in 2009. October sales plummeted by 36% YoY, contributing to a 26% YoY decline across the first ten months as a whole. Preliminary data indicated that volumes in November remained lackluster (-31% YoY), while the month’s estimated selling rate was 507k units/year, a slight improvement over October, yet still a disappointing outcome. As such, the Thai 2024 sales projection has been revised downward to a 15-year low of 565k units, representing a decline of 26% YoY.

Although Malaysia’s LV volumes increased by 3% YoY from January to November 2024 overall, the market began to decelerate and saw declines for four consecutive months in the second half of the year: -0.1% YoY in August, -12% YoY in September, -6% YoY in October, and -7% YoY in November. This was due to Perodua’s large backlog of orders - the main growth driver in recent years - being fulfilled. It was also partly due to the high base in H2 2023. As a result of this declining trend, Malaysia’s 2024 sales forecast has been slightly lowered from 808k units to 806k units.

Nevertheless, this outlook is still a new record high, and Malaysia has become the largest ASEAN new LV market for the first time, surpassing Indonesia and Thailand, which faced sluggish LV demand in 2024.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

"GlobalData raises 2024 ASEAN vehicle market forecast" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.