The Federal Reserve let the inflation-worry cat out of the bag this week.

And at the world’s largest publicly traded hedge fund, Man Group UK:EMG, the threat of higher prices has been top of mind for Ed Cole, head of multistrategy equities, and his clients, he told MarketWatch in a recent interview.

“Our biggest concern in 2025 is inflation reaccelerating. We think there’s a reasonable probability of that happening, irrespective of whatever policy the next U.S. government implements, there is just enough evidence in leading indicators of inflation in various key areas like shelter in particular, that the inflationary forces back up again,” Cole said.

“And, obviously, that would be pretty problematic for high-multiple stocks, and could be quite hard for markets in general, bearing in mind that in inflationary periods, you typically don’t get bailed out by your bond portfolio if your equity portfolio sells off as well,” said the strategist.

He worries U.S. inflation could be “in the 3s” by mid-2025, tough for stocks with big multiples. “What we saw in 2022 is that high-multiple stocks de-rate in inflationary environments, so that’s where the real pain is. And stocks that have short-term cash flows, and where those cash flows can adapt to the inflationary environment, typically do much better.”

See: Fed-favored inflation gauge surprises by showing slower price increases in November

Individual investors who are concerned should start building exposure to assets that benefit from inflation, such as copper, a core industrial metal that “benefits from environments where nominal GDP is rising.”

He said copper miners can offer protection. Cole sees years of post-COVID destocking ending in 2025, with restocking supportive for manufactured goods. “Copper is obviously in everything, in all manufactured goods, but principally shows up a lot in electrification and clean tech. So it has huge structural tailwinds. We think it has some cyclical tailwinds,” he adds.

The strategist also likes gold miners, noting the precious metal has been “well supported” by central-bank buying. Cole said amid rising interest rates, ETF flows “have been very negative.” But that seems to have shifted, meaning “you probably have, coincidentally now, the two big, typical buyers of gold turned buyer at the same time,” he said.

And Cole says China has been overlooked by markets, as he thinks the government will do more than expected to support the economy after a “material pivot” in late September. Plus potential for a U.S.-China tariff deal should not be overlooked, as he says the latter holds some cards. “They signaled they may devalue their currency, which the U.S. would not want.”

He also sees opportunity in technology stocks but prefers software over semiconductors, given that the latter faces potential headwinds from trade wars. “The software sector as a whole we like, globally. We think 2025 is a year where we’re going to see software spending increasing — it was pretty soft in 2024.”

They like “household names,” some of which are selling artificial-intelligence add-ons to their software packages, he said. “These are the kind of companies that are sort of the first adopters of AI technology and finding ways to monetize that without them necessarily being killer apps.”

Cole offered some final thoughts on what he sees as an all-in investor view of the U.S. right now.

The response to the U.S. presidential election “has been for markets to assume that the U.S. will win at the expense of everywhere else in the world, which is generally what has played out in equity markets. It’s not obvious to us that that’s how 2025 will go,” he said, noting that this comes at time when the U.S. premium to equities in the rest of the world, based on trailing data, looks to be wider than it’s been in 30 years.

The 2000s, Cole noted, marked a decade of “massive emerging-markets dominance,” with few doubting that this dominance over the more developed markets would end. “And the decade that followed was absolutely horrendous for emerging markets.”

Still, Cole said, he’s “also clear that these excesses can go on for a very, very long time, and it doesn’t pay to bet hard against them just because things are expensive.”

The markets

U.S. stocks SPX DJIA are trading lower early Friday, led by tech COMP. Traders are bracing for trillions in options expirations .

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5867.08 |

-3.04% |

-1.37% |

23.00% |

23.60% |

|

Nasdaq Composite |

19,372.77 |

-2.66% |

2.11% |

29.05% |

29.46% |

|

10-year Treasury |

4.554 |

15.80 |

14.30 |

67.31 |

65.72 |

|

Gold |

2618.4 |

-1.78% |

-3.67% |

26.38% |

26.83% |

|

Oil |

69.1 |

-2.80% |

-2.94% |

-3.13% |

-5.97% |

|

Data: MarketWatch. Treasury yields changed expressed in basis points |

|||||

The buzz

Nike shares NKE are dropping, with investors looking past a sales and earnings beat to new CEO Elliott Hill’s ambitious turnaround plan.

FedEx’s stock FDX is up after an announced freight-business spinoff.

Local shares of Danish drug maker Novo Nordisk DK:NOVO.B NVO slid 19% on disappointing data for its weight-loss injection , with shares of rival Eli Lilly LLY jumping.

The Fed’s preferred inflation gauge, the PCE price index, showed prices rose 0.1% in November on both a core and headline basis, and both were below Wall Street forecasts.

A shutdown of parts of the federal government could begin after midnight on Friday, after the House rejected the latest plan, with 38 Republicans jumping ship even after President-elect Donald Trump’s endorsement. Here’s what it means for TSA, IPOs and Social Security . Trump, along with adviser Elon Musk, had previously turned against bipartisan legislation to keep the government open till March.

Best of the web

After Roaring Kitty and ‘Trump trades,’ what memes will bring in 2025

Americans are suddenly, mysteriously getting healthier

There’s a climate cost of obesity wonder drugs, warns this CEO

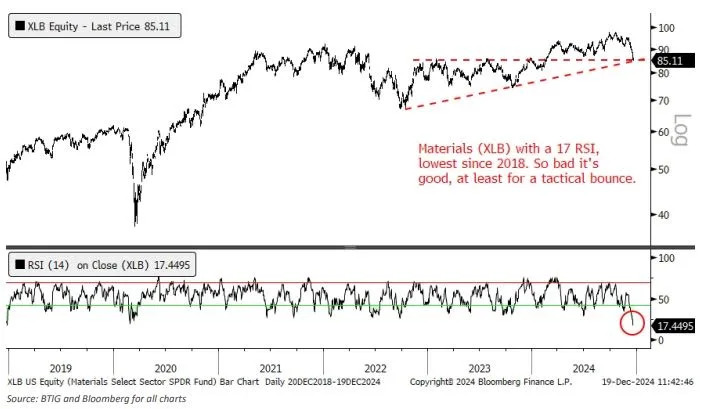

The chart

The above chart from Jonathan Krinsky, chief market technician at BTIG, shows materials, measured by the Materials Select Sector SPDR ETF XLB, as 2024’s worst-performing sector, down 1.4% to date. It’s also the most oversold — XLB’s relative strength index, a gauge of price momentum, is the lowest since 2018, so ripe for a bounce, he says. He flags Sherwin-Williams SHW, Vulcan Materials VMC, LyondellBasell Industries LYB, Amcor AMCR and Eastman Chemicals EMN as possible beneficiaries.

Top tickers

These were the most active stock-market ticker symbols on MarketWatch as of 6 a.m. Eastern time:

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

PLTR |

Palantir Technologies |

|

MSTR |

MicroStrategy |

|

TNXP |

Tonix Pharmaceuticals |

|

AMD |

Advanced Micro Devices |

|

AAPL |

Apple |

|

RGTI |

Rigetti Computing |

|

TSM |

Taiwan Semiconductor Manufacturing |

Random reads

Mosh-pit diapers are selling out.

The perfect age to tell your kids Santa ain’t real

Fake nails were also a thing with ancient Egyptians .