Hello! This week’s ETF Wrap looks at the hazard of narrow breadth in the S&P 500, as U.S. stocks have struggled after Wednesday’s Federal Reserve’s policy meeting.

Please send feedback and tips to christine.idzelis@marketwatch.com or isabel.wang@marketwatch.com. You can also follow me on X at @cidzelis and find me on LinkedIn . Isabel Wang is at @Isabelxwang .

Sign up here for our weekly ETF Wrap.

The perils of a top-heavy S&P 500 SPX fell into focus on Wednesday, with tumbling Big Tech stocks dragging down the index as investors weighed the outcome of the Federal Reserve’s meeting.

As recently as Dec. 16, the top 10 stocks in the S&P 500 had a total 39% weight in the U.S. equities index — a record level based on data going back to 1980, said Todd Sohn, an ETF strategist at Strategas, in a phone interview. The SPDR S&P 500 ETF Trust SPY, which tracks the widely followed U.S. stock benchmark, dropped 3% on Wednesday, as investors fretted over the prospect of a potentially slower pace of interest-rate cuts next year amid sticky inflation.

After slipping Thursday, shares of the ETF were heading for a weekly decline of 3%, which would mark its worst week since early September, according to FactSet data. Big Tech stocks known as the Magnificent Seven — including Apple Inc. AAPL, Microsoft Corp. MSFT, Nvidia Corp. NVDA, Amazon.com Inc. AMZN, Google parent Alphabet Inc. GOOGL GOOG, Facebook parent Meta Platforms Inc. META and Tesla Inc. TSLA – are among the top 10 weights in the S&P 500 index.

Investors fear a plunge in technology stocks and waning enthusiasm for artificial intelligence as among the biggest risks to market stability in 2025, according to Deutsche Bank Research. Although the Roundhill Magnificent Seven ETF MAGS sank 4.4% on Wednesday — its worst day since late July — the ETF is still widely beating the S&P 500 this month, according to FactSet data.

Big Tech stocks have soared this year on investors’ optimism about AI, fueling the S&P 500’s strong gains in 2024. On the surface, their hefty influence may make the index’s rally appear healthier than it is, as many other stocks may be struggling under the hood of the S&P 500.

Megacap stocks can “mask a lot of the internal weakness,” said Sohn. If they don’t perform well, he said, that risks becoming “very challenging” for the S&P 500 should it be left struggling with bad breadth.

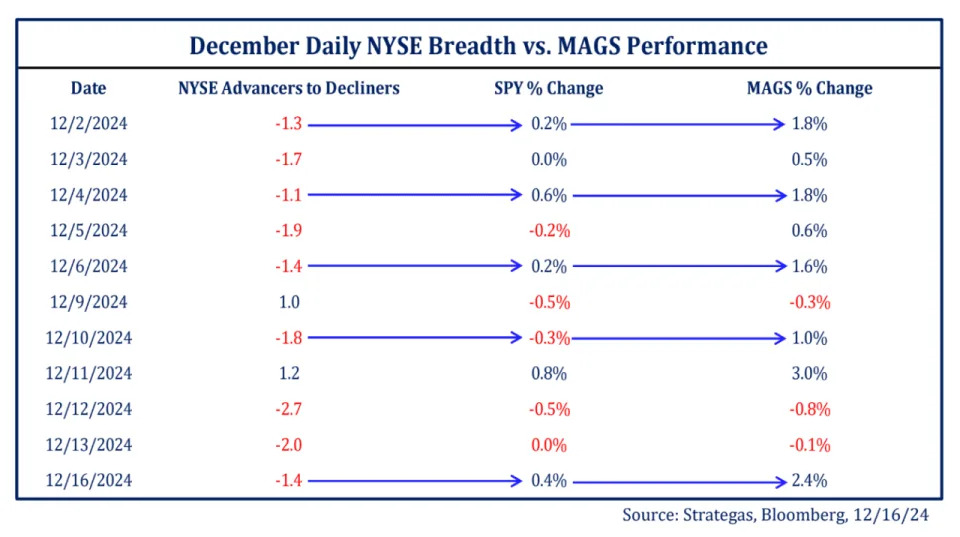

On Dec. 16, when there were more stocks declining on the New York Stock Exchange than advancing, the S&P 500 rose modestly, lifted by a sharp rally in Big Tech stocks. The S&P 500 ETF trading under the ticker symbol SPY gained 0.4% that day, while the Magnificent 7 ETF jumped 2.4%, Sohn noted in Strategas research earlier this week.

The S&P 500 has declined 2.7% so far in December, while the Big Tech-focused Roundhill Magnificent Seven ETF has jumped 7.9%. The Magnificent Seven ETF ended Thursday on track for a weekly drop of 1.4% — potentially snapping four straight weeks of gains, according to FactSet data.

“Regarding breadth, the percentage of S&P 500 stocks” above their 50-day moving average “slipped below 50% last week, the lowest since early July, just prior to the volatile late-summer selloff in stocks,” Tyler Richey, a chartered market technician at Sevens Report Research, had warned in a Dec. 16 note.

Meanwhile, the Invesco S&P 500 Equal Weight ETF RSP, which equally weights stocks in the S&P 500 index, has been faring worse than the S&P 500 lately. The ETF is down 7.1% so far this month through Thursday.

Although the S&P 500 is down this week in the wake of Wednesday’s sharp drop, the U.S. equities benchmark has rallied 23% so far in 2024. The index ended Thursday 3.66% below its record closing high of 6,090.27 logged Dec. 6, according to Dow Jones Market Data.

“Wednesday’s stock-market pullback is understandable, given the steep run we have seen in stocks since the election and since the start of the year, and the fact that market breadth had been narrowing in recent days,” said Carol Schleif, chief market strategist at BMO Private Wealth, in emailed comments Thursday.

Big Tech stocks have soared in 2024, with the Roundhill Magnificent Seven ETF — which provides equal-weight exposure to Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla — up almost 67% through Thursday, according to FactSet data.

Related: Ways to target – or avoid — Big Tech and megacap stocks via ETFs amid AI frenzy

For investors who are seeking to decrease their concentration to megacap stocks, Sohn cited funds such as the Defiance Large Cap ex-Mag 7 ETF XMAG, Astoria US Equal Weight Quality Kings ETF ROE, iShares Nasdaq-100 ex Top 30 ETF QNXT and Invesco S&P 500 Equal Weight ETF.

For those who want to lean into megacap concentration, he pointed to the Roundhill Magnificent Seven ETF, Invesco Top QQQ ETF QBIG, iShares Nasdaq Top 30 Stocks ETF QTOP and iShares Top 20 US Stocks ETF TOPT as options for going that avenue.

As usual, here’s your look at the top- and bottom-performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

|

Top performers |

%Performance |

|

Defiance Quantum ETF QTUM |

12.7 |

|

Invesco DB Agriculture Fund DBA |

1.3 |

|

Franklin Bitcoin ETF EZBC |

0.6 |

|

Grayscale Bitcoin Mini Trust ETF BTC |

0.6 |

|

Invesco Galaxy Bitcoin ETF BTCO |

0.6 |

…and the bad

|

Bottom performers |

%Performance |

|

iShares MSCI Brazil ETF EWZ |

-12.9 |

|

Global X Silver Miners ETF SIL |

-11 |

|

iShares Latin America 40 ETF ILF |

-10.2 |

|

Amplify Junior Silver Miners ETF SILJ |

-9.5 |

|

YieldMax COIN Option Income Strategy ETF |

-9.5 |