Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter .

While homebuyers and home sellers still see headlines about the housing market being a seller’s market and national home prices reaching all-time highs, a deeper look reveals that several regional housing markets have shifted, giving homebuyers some power.

During the pandemic housing boom, from summer 2020 to spring 2022, the number of active homes for sale in most housing markets plummeted as homebuyer demand quickly absorbed almost everything that came up for sale. Fast-forward to the current housing market, and the places where active inventory has rebounded to 2019 levels (due to strained affordability suppressing buyer demand) are now the very places where homebuyers hold the most power.

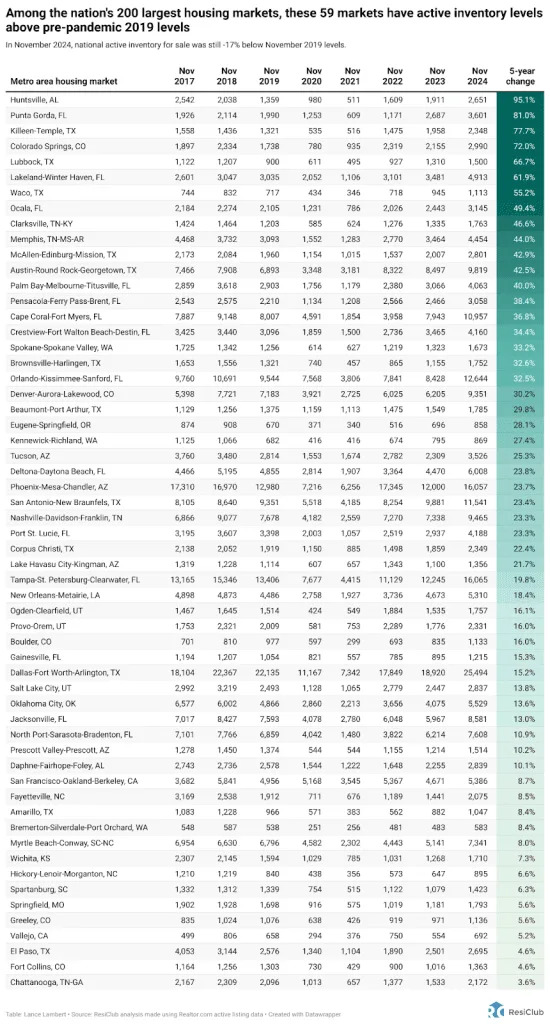

In November 2024, national active inventory for sale was still 17% below November 2019 levels. However, more and more regional markets are surpassing that threshold.

Among the nation’s 400 largest metro area housing markets, 59 markets ended November 2024 with more active homes for sale than they had in pre-pandemic November 2019. These are the places heading into 2025 where homebuyers will be able to find the most leverage or market balance.

Many of the softest housing markets, where homebuyers have gained leverage, are located in Gulf Coast and Mountain West regions. These areas were home to many of the nation’s top pandemic boomtowns, which experienced significant home price growth during the pandemic housing boom, which stretched housing fundamentals far beyond local income levels.

When pandemic-fueled migration slowed and mortgage rates spiked, markets like Punta Gorda , Florida, and Austin, Texas, faced challenges as they had to rely on local incomes to sustain frothy home prices. The housing market softening in these areas was further accelerated by the abundance of new home supply in the pipeline across the Sun Belt. Builders in these regions are often willing to reduce prices or make affordability adjustments to maintain sales. These adjustments in the new construction market also create a cooling effect on the resale market, as some buyers who might have opted for an existing home shift their focus to new homes where deals are still available.

In contrast, many Northeast and Midwest markets were less reliant on pandemic migration and have less new home construction in progress. With lower exposure to that demand shock, active inventory in these Midwest and Northeast regions has remained relatively tight, keeping the advantage in the hands of home sellers.

Generally speaking, housing markets where inventory (i.e., active listings) has returned to pre-pandemic levels have experienced weaker home price growth (or outright declines) over the past 24 months. Conversely, housing markets where inventory remains far below pre-pandemic levels have, generally speaking, experienced stronger home price growth over the past 24 months.

This post originally appeared at

fastcompany.com

Subscribe to get the Fast Company newsletter:

http://fastcompany.com/newsletters