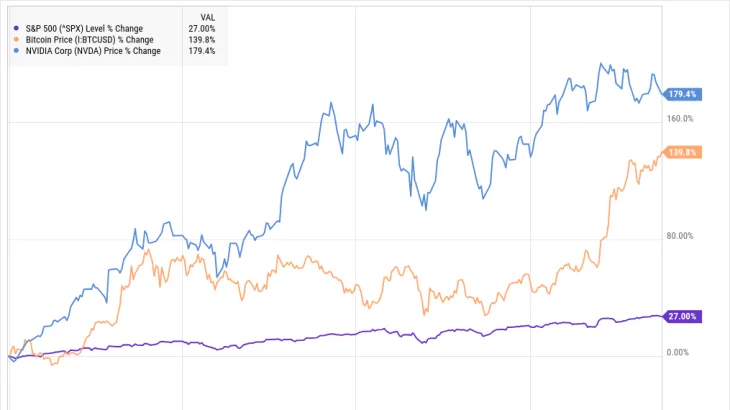

On Friday, the price of bitcoin plunged to almost $92,000 before rebounding to more than $97,000, despite reaching a new all-time price high of more than $108,000 on Tuesday.

Part of the sell-off was catalyzed by Wednesday’s news that the Federal Reserve would not hold bitcoin in its reserve, prompting the world’s largest cryptocurrency to dip by 7%.

"We’re not allowed to own bitcoin,” Federal Reserve chair Jerome Powell said. “The Federal Reserve Act says what we can own, and we’re not looking for a law change. That’s the kind of thing for Congress to consider, but we are not looking for a law change at the Fed."

Overall, the global crypto market cap dipped by 1.2%, reaching $3.52 trillion, according to CoinGecko .

Ethereum, the world’s second-largest digital asset, also dropped by 10%, though it recovered Friday morning by reaching a price near $3,467. Meanwhile, Solana, the world’s sixth-most valuable cryptocurrency, with a market cap of $92 billion, is currently trading at $192 at the time of writing, after dropping 10%.

On Thursday, bitcoin exchange-traded funds (ETFs), which debuted this January, saw their first outflows in weeks, with bitcoin ETFs seeing $650 million in outflows. Meanwhile, Ethereum ETFs saw outflows exceeding $60 million .

With the upcoming holiday season on the horizon, some market analysts underlined that "mixed behavior" over Christmas and New Year was to be expected: "The first rule of bitcoin is that it is always volatile in the same way water is always wet," said James Toledano, Chief Operating Officer at Unity Wallet. "It’s behavior is always mixed and there is zero discernible pattern at the end of the year going into the next. Sometimes the price rises in the new year and at other times it falls. So, historically, we can say that bitcoin exhibits typically mixed behavior over Christmas and New Year."

"While reduced liquidity can heighten volatility, the absence of major institutional activity may actually stabilize prices," Toledano added. "Notable exceptions include years when macroeconomic news or market catalysts spark sudden moves. This year, much depends on investor sentiment following 2024’s [exchange-traded fund] approval and the Trump-factor as well as other macro trends. A relatively quiet period is possible unless unexpected news reignites volatility. But given that on January 20th, pro-bitcoin Trump will be back in the White House, I think we can expect a lot of price movement again very soon," he said.