Key Takeaways

MicroStrategy ( MSTR ) was an obscure software company until it started making a massive bet on bitcoin ( BTCUSD ).

Shares of the company have gained more than 400% since the start of 2024, as bitcoin has surged to record highs above $100,000 amid optimism that the digital currency will benefit from policies that the incoming Trump administration and a crypto-supportive Congress are likely to put in place.

MicroStrategy, little known to most investors before this year's rally, is now stepping further into the spotlight as it joins the Nasdaq 100 Index , which comprises many of the largest, most actively traded companies in the world, including Nvidia ( NVDA ), Apple ( AAPL ) and Tesla ( TSLA ). As a result, exchange-traded funds that track the index, such as the Invesco QQQ Trust ( QQQ ), have to adjust their portfolios to include MicroStrategy.

Analysts have expressed optimism that the rally in MicroStrategy shares has more room to run given the positive outlook for bitcoin and the strategy that the company employs of using leverage to build its bitcoin holdings. However, some investors have said the blockbuster stock price gains aren't sustainable, in part because of the leverage.

MicroStrategy Stock Gains Far Outpace Bitcoin's

MicroStrategy shares have generally mirrored bitcoin's directional moves as the company has built its stake in the cryptocurrency. The strategy of using leverage, however, has translated into stock price gains that have far outpaced bitcoin, which is up about 125% since the start of the year.

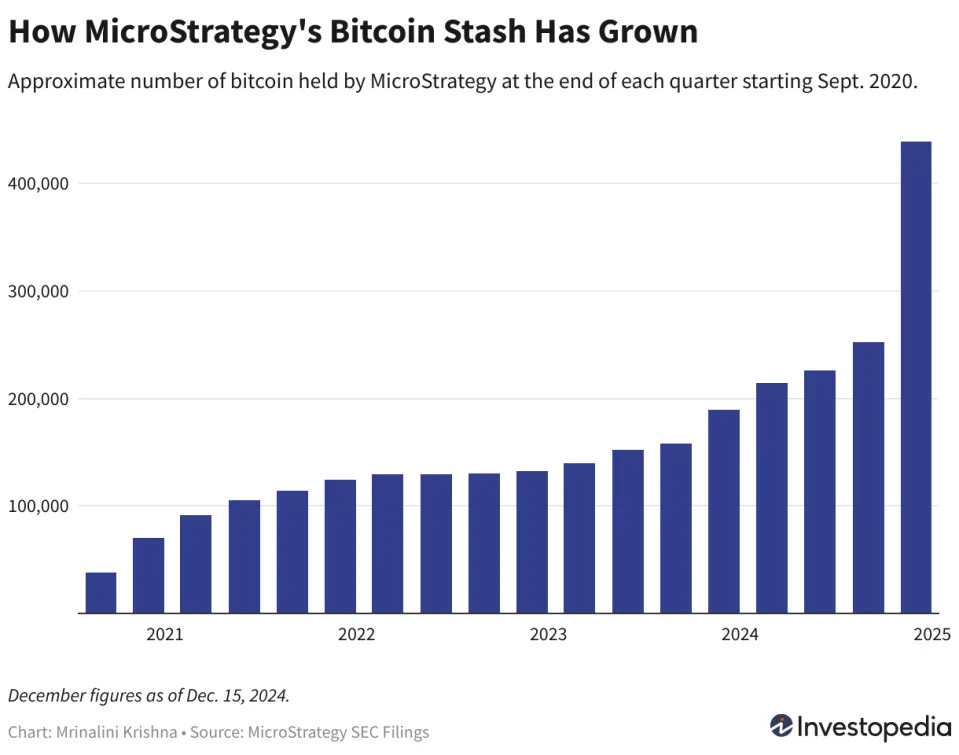

The company, which hasn't turned a profit in any quarter this year, purchased its first batch of bitcoin in 2020, when it was trading close to $11,000. Just seven years prior, then-CEO Michael Saylor had said bitcoin’s “days are numbered.”

In a recent CNBC interview Saylor, who now serves as chairman, called MicroStrategy a bitcoin treasury operations company. The company has purchased the cryptocurrency 45 times since 2020 for a total of 444,262 BTC on its books. That’s more than 2% of the 21 million bitcoin that will ever exist, making MicroStrategy the second-largest corporate holder of the asset behind BlackRock’s iShares Bitcoin Trust ( IBIT ).

The company measures its bitcoin investment success using a metric called bitcoin yield, loosely translated to how its ownership of bitcoin has changed per outstanding share of the company.

At the end of last year MicroStrategy held 189,150 bitcoins and its assumed diluted shares outstanding figure was 207,636, making the ratio 0.91. As of Dec. 23, with the company's bitcoin holdings soaring to 444,262 BTC and its outstanding shares at 280,828 the ratio was 1.576. The year-over-year percentage change between the two ratios, or the bitcoin yield, therefore stood at 73.1%.

MicroStrategy said in a regulatory filing this month that the yield "can be used to supplement an investor’s understanding of the Company’s decision to fund the purchase of bitcoin by issuing additional shares of its common stock or instruments convertible to common stock."

A 'Leveraged Play on Bitcoin'

The company issues equity or

zero-coupon debt

backed by a small amount of its existing bitcoin reserves in order to buy larger quantities of bitcoin using simple

arbitrage

. The company plans to raise $42 billion using those methods over three years, it announced in October, and it's racing towards that goal.

The company has increasingly been relying on issuing shares to buy bitcoin, but when it opts for

convertible debt

, purchasers of the debt could get an option to convert it to MicroStrategy shares at a certain price, almost akin to a

call option

.

"When we do it with debt, we issue $3 billion of debt that's backed by $600 million of bitcoin, it comes due in five years, we pay 0% interest. We buy $3 billion of bitcoin, we capture the $2.4 billion in the arbitrage gain upfront. But then over the course of the five years, we double or quadruple the investment, because we're buying an asset which is appreciating faster than the S&P," Saylor told CNBC.

According to analysts at Bernstein, “MicroStrategy presents a leveraged play on Bitcoin.” Bernstein recently raised its price target on the stock to $600, from $290 previously. The stock is currently trading around $360.

The analysts say the longer tenure of the debt gives the company some cushion against immediate repayment or volatility in bitcoin prices. Also, even if MicroStrategy has to issue shares to meet the convertible debt obligations, those will have a limited effect in diluting the company's equity, according to Benstein.

Some Say Stock Headed for Correction

Not everyone is convinced MicroStrategy's performance is sustainable.

Take short seller Citron Research, which remains bullish on bitcoin but opened a short position in MicroStrategy as a hedge, in essence betting on the stock price to fall.

“Much respect to @saylor, but even he must know $MSTR is overheated,” said short seller Citron Research in an X post in November, adding that the company’s trading volumes are “completely detached” from bitcoin fundamentals.

Galaxy Digital CEO Mike Novogratz told

CNBC

recently that because of leverage he expects a sharper correction in bitcoin-related stocks such as MicroStrategy than in the cryptocurrency itself.

Update, Dec. 23, 2024: This article has been updated to reflect MicroStrategy's latest bitcoin purchase.

Read the original article on Investopedia