Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter .

Michael Zuber began building his rental property portfolio in Fresno, starting with his first properties in 2001. He sold off much of his real estate portfolio right before the 2008 housing bust and then reentered the market after home prices crashed.

By 2018, Zuber had grown his portfolio to more than 170 rental properties and made the decision to leave his tech job in Silicon Valley to focus on his passion for helping others achieve similar success. His YouTube channel, One Rental at a Time , has since amassed more than 60,000 followers, most of whom are single-family landlords themselves.

Zuber studies the financial and housing market every day and has become a leading voice in the mom-and-pop landlord space —which represents the largest share of rental-property owners in the U.S.

ResiClub ‘s Meghan Malas recently interviewed Zuber about his insights and approach.

Interest rates have gone up a lot since early 2021, so a lot of institutional capital that was moving into the space has pulled back. However, we are still seeing, on a percentage basis, a good number of single-family landlord purchases from mom-and-pop single-family landlords. How are single-family investors still finding deals that pencil in this type of market?

Mom-and-pop landlords have an advantage over Wall Street money because they’re far more nimble. They only need to find one property versus dozens, making it easier in today’s environment to find the needle in the haystack. Institutional investors these days focus on newer homes, often less than a decade old, with three or four bedrooms.

Mom-and-pop landlords can target properties that don’t fit the institutional “buy” box, finding ugly ducklings or missed listings. And while institutions rely on technology to query the market for deals, mom-and-pop landlords network and evaluate deals locally.

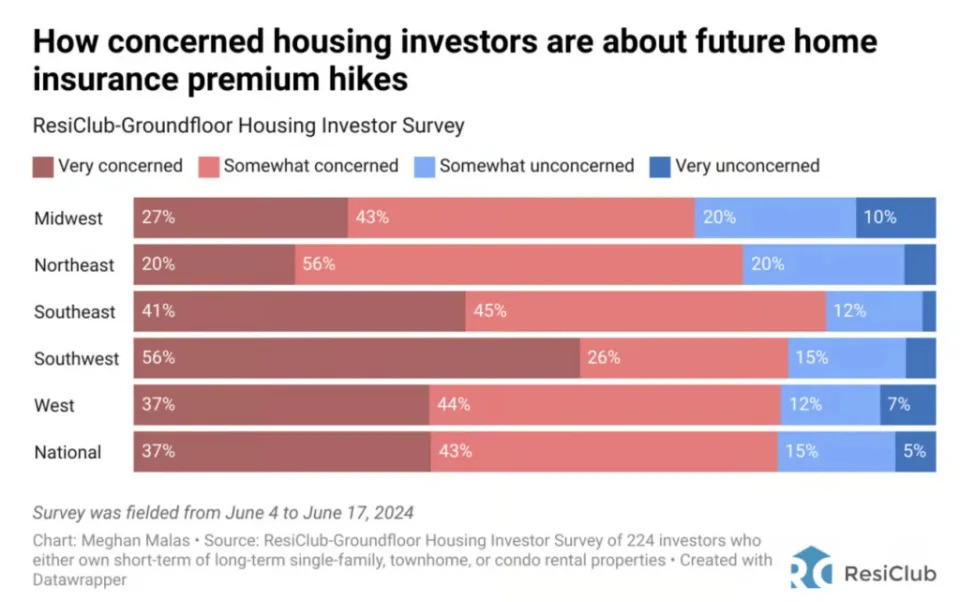

Back in June, a ResiClub-Groundfloor Housing Investor Survey found that 80% of real estate investor-landlords are concerned about home insurance shocks. What should single-family investors be mindful of on the insurance front?

Insurance has become a front-and-center issue for landlords. For over 25 years, I could estimate my insurance costs within $20 or $30. But in the last two years, we started facing nonrenewals and cancellations. In California, there was a period when insurance companies were leaving the market altogether.

For years, I had a fourplex where insurance was consistently around $1,900. When my provider refused to renew, the next carrier charged almost $3,200 for the same coverage.

Thankfully, in the last six months, the rate shocks, cancellations, and nonrenewals seem to be easing. And if you’ve been in the game long enough, you’ve likely benefited from significant rent increases between 2020 and 2023. While insurance costs might have jumped 50%, those rent increases have often outpaced them.

As long as you’re managing your units effectively, the higher insurance costs—while they hurt cash flow—are manageable.

You’ve said before that today’s housing market resembles that of the early 1980s—a time of significantly strained housing affordability in the U.S.—can you explain why?

Between 1978 and 1982, we saw a dramatic increase in rates, which sharply reduced transactions. I made this call in 2022 right after the Jackson Hole meeting, where Jerome Powell essentially said, “Pain is coming.”

In my 54-year spreadsheet , you can see the pattern: From 1978 to 1981, existing home sales transactions went down 50%, but the median home price went up.

In 2022, when I predicted a crash in housing transactions alongside rising [national home] prices, many dismissed it as foolish. Unfortunately, that’s exactly what occurred.

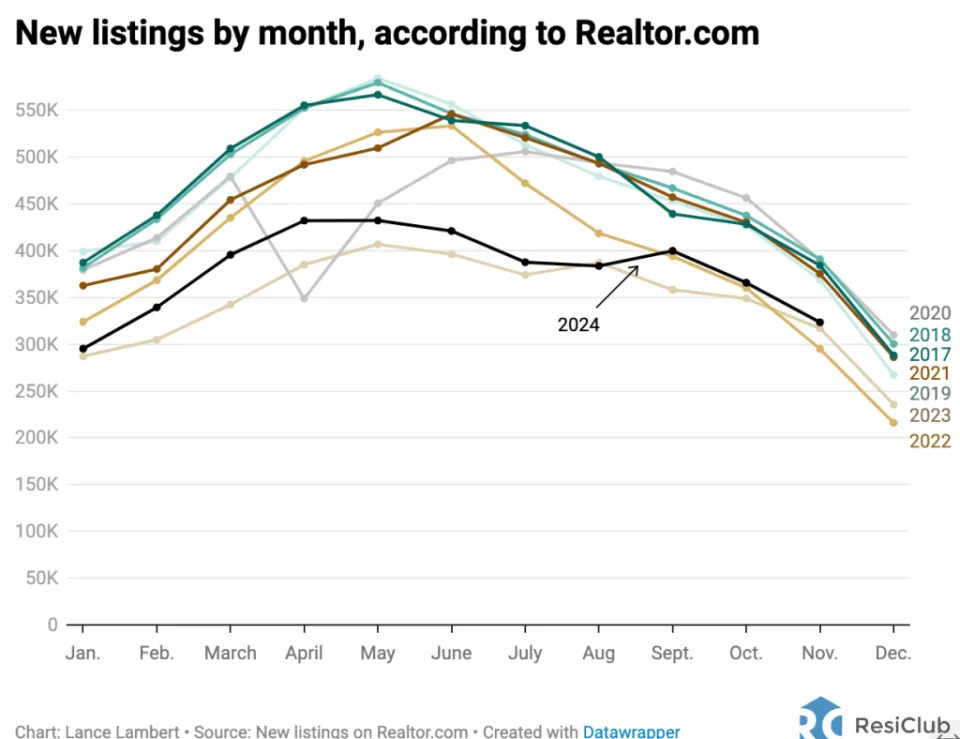

Even before existing home sales—and new listings—plummeted in 2022, you said that the “Fed broke the housing market.” What did you mean by that, and is that still true heading into 2025?

Traditionally, the housing market follows a normal cycle. First-time homebuyers purchase a home, stay for six to eight years, and then move up. This cycle operated consistently for 40 years.

But consider someone who bought an entry-level home in 2020 or 2021. Today, it’s likely they could not afford their current home due to its price increase of 25% to 50%, let alone trade up for a better home. The math no longer works. The home they want to buy is $100,000 more expensive, and mortgage rates have jumped from 3% to 7%. As a result, the “move-up buyer” has effectively disappeared from the market.

The lack of move-up buyers breaks the housing market because their activity represents two transactions—a sale and a purchase. Without them, entry-level housing stays frozen. The homes selling are higher-end or luxury properties, which skews the market. Median home prices appear higher because lower-priced homes aren’t [selling].

Comparing how many entry-level homes sold in 2019 or 2020 to sales in 2024 or 2025 shows a significant drop—around 30% fewer. This is what defines a broken housing market.

What is your outlook for the housing market in 2025?

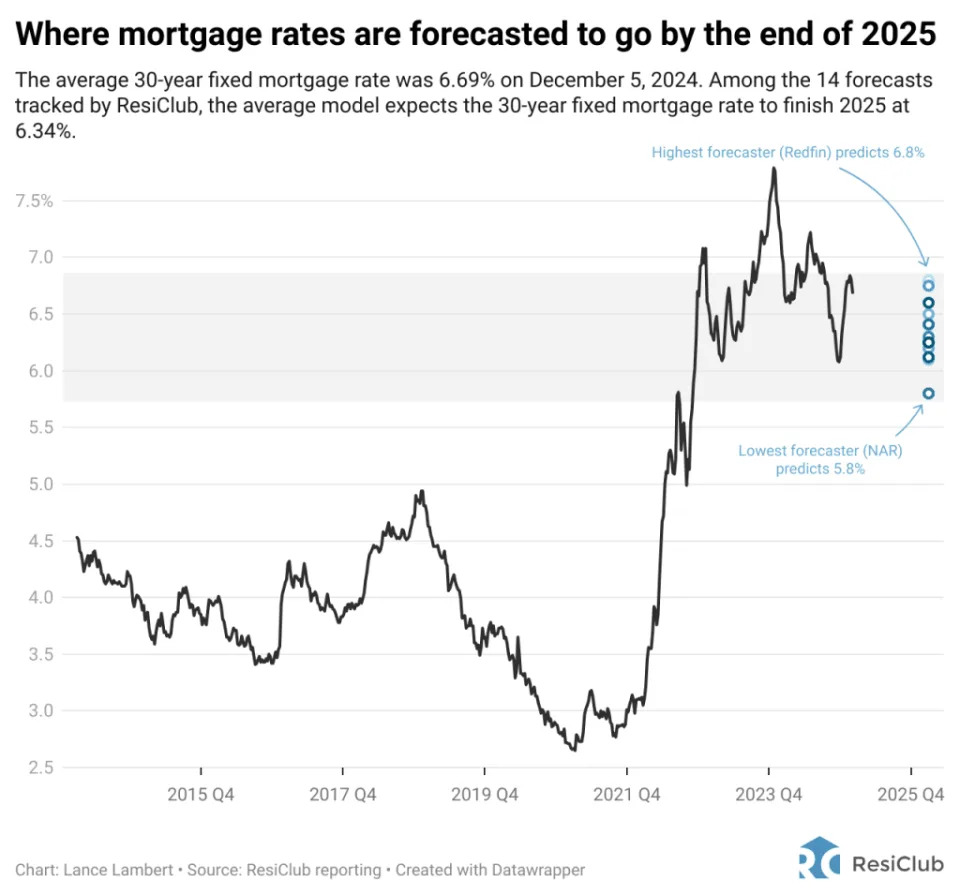

My call for 2025 is essentially “higher for longer.” Rates might be lower at the end of the year than at the beginning, but on average, 7% seems likely.

Almost no one with a 3% mortgage on an entry-level home will trade up to a 7% rate—it simply doesn’t make financial sense. As a result, 2025 will likely be another slow year with low transaction volume. I expect national home prices to stay flat, rising by 1% or 2% in 2025.

I predict more new home sales in 2025, but square footage will shrink. Builders are likely to focus on smaller, entry-level homes.

I also believe the incoming administration will work to make housing construction faster and cheaper, possibly offering incentives for building entry-level housing. I do not foresee any “free money” first-time homebuyer programs. The last thing the market needs is more demand; we need supply. If such a program materializes, my call for 2025 would be wrong, as it would disrupt the current dynamics.

Many people see real estate as a way to build wealth for retirement, but they don’t want to manage properties forever. As someone who once owned over 170 rentals, when did you decide to downsize, and how did you plan your exit?

You don’t have to self-manage. From the beginning, [my wife and I] chose to invest in a market two and a half hours away while working demanding full-time jobs. Property management was a necessity for us, so we found deals that could support paying a 10% management fee.

While we no longer pay 10% today, having property managers from Day One has helped reduce the operational stress of direct management. That said, managing the manager is still essential. We’ve had to fire property managers, deal with theft, and oversee operations to ensure everything ran smoothly.

However, we’ve never spoken directly to tenants, collected rent, or called for repairs. We’ve always paid someone else to handle those tasks.

As you approach retirement, other considerations come into play. For example, should you sell older properties and use a 1031 exchange to acquire newer ones? Newer properties typically require less management, which can significantly reduce headaches. A 1031 exchange also allows you to consolidate multiple properties into a single, higher-quality asset.

This post originally appeared at

fastcompany.com

Subscribe to get the Fast Company newsletter:

http://fastcompany.com/newsletters