After a hawkish pivot from the Federal Reserve sparked a tumultuous week in markets, one voice in the crypto VC world is pointing to brighter days ahead.

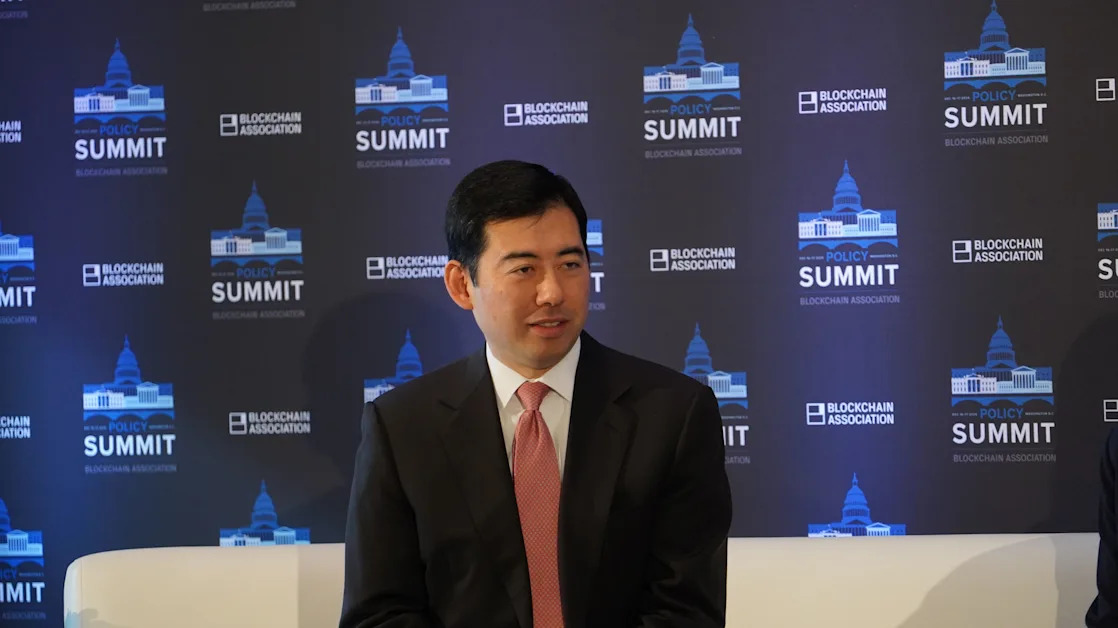

Cosmo Jiang, portfolio manager at Pantera Capital — which just celebrated an eye-popping 1,000x return on its original Bitcoin fund — joined Coinage to share his insights on where the market stands and why he believes altcoin season is officially underway.

Reflecting on the recent market volatility, Jiang provided a clear perspective on the forces at play. “It became pretty clear that the Fed governors… are a lot more concerned about inflation staying higher for longer,” Jiang explained. But fewer rate cuts in 2025 isn't necessarily a cause for panic — particularly when it comes to the beginning of non-Bitcoin cryptocurrencies playing catchup.

Jiang is cited as one of the leading fundamental investors in crypto . Jiang's bets at Pantera have proved prescient . Pantera's largest-ever investment in TON has played out nicely as the Telegram-linked coin enjoys a more than 100% rally this year. Now, Jiang sees other opportunities emerging.

“In these cycles, Bitcoin is the first to really perform… It’s really in that second phase though, when everything else, or what we call longer-tail tokens, really start to outperform,” he said. Highlighting the fundamental drivers of this dynamic, Jiang explained, “On the supply side… there’s more things to invest in and to get excited about. And on the demand side, now that investors have made a good amount of money on Bitcoin hitting new highs, they’re more comfortable seeking out these… potentially higher growth tokens.”

One of the most telling metrics investors track is Bitcoin dominance, which measures Bitcoin’s share of the total crypto market cap. “Post-election, Bitcoin dominance… declined from 60 to 54 at some point,” he noted. “Nearly ten points of relative outperformance by everything else.” For Jiang, this signals the early stages of a broader shift , as capital flows into altcoins gain momentum.

Among the altcoins, Jiang spotlighted Solana as particularly noteworthy. “When we talk to… large bank wirehouses… 90, 95% of their conversations are about Bitcoin. But the next most talked about token is Solana,” he observed. This growing institutional interest underscores the project’s progress and potential. “People are aware of what stuff is working, where the growth is. And people just want to buy assets that represent tokens that represent protocols that are growing and doing very well,” Jiang said.

Looking beyond individual tokens, Jiang expressed excitement about broader innovation within the blockchain space. “You’re seeing users, transaction activity really skyrocketing on Solana, on Ton,” he shared. Additionally, he highlighted emerging trends in decentralized physical infrastructure (DePIN) and AI, calling them “two areas that really take up all my brain space today.” Projects like Helium , Hivemapper, and GEODNET have found real-world use cases, attracting partnerships with major corporations and even government entities.

“Crypto is creating a better product at a cheaper price,” Jiang said, describing the unique value proposition of these protocols.