(Bloomberg) -- As Donald Trump prepares to fulfill a lengthy list of campaign promises, the president-elect’s vow to ensure that all remaining Bitcoin is “made in the USA” may prove to be one of the most challenging to keep.

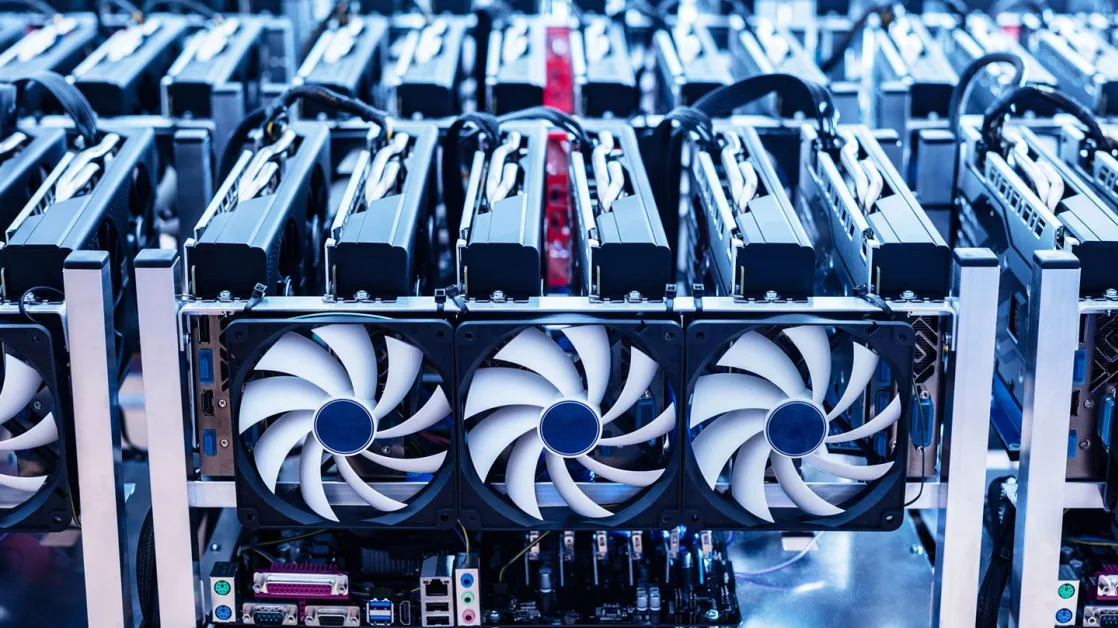

Trump made the pledge in a post on his Truth Social account in June after meeting at Mar-a-Lago with a group of executives from crypto miners, the companies whose massive, high-tech data centers do the work that facilitates transactions on the blockchain in exchange for compensation paid in Bitcoin or other cryptocurrencies. The gathering was a key juncture in Trump’s transformation from a crypto skeptic to one of the industry’s strongest allies.

“It is a Trump-like comment but it is definitely not in reality,” said Ethan Vera, chief operating officer at Seattle-based Luxor Technology, which provides software and services to miners.

While seen widely as a symbolic pledge of support, it’s near impossible in practice since blockchains are decentralized networks in which no one controls or can be banned from participating in the process. On a practical basis, the sector is becoming increasingly competitive as large-scale operations pop up across the world to get a slice of the tens of billions of dollars in revenue generated each year by the industry.

Russian oligarchs, Dubai royal families and Chinese businessmen in Africa are some of the freshest competitors. Deep pockets and access to vast amounts of power are spurring them to join in on the lucrative but energy-intensive process. About 95% of the 21 million Bitcoin that will ever be created have already been minted, though the hard cap on production isn’t expected to be met for about 100 years.

The Bitcoin mining sector in the US has morphed into a multi-billion dollar industry over the last several years as the token saw exponential increases in prices. However, the total computing power generated from US-based miners is well below 50% and it is impossible to power the entire network by domestic companies, according to industry analysts.

While there is no public data to indicate the sources of computing power from each region across the world, large crypto-mining service providers such as Luxor tend to have good insight on the makeup. They have more specific information on mining locations through their software that aggregates computing power to increase chances for miners to get Bitcoin rewards.

US miners such as CleanSpark Inc. and Riot Platforms Inc. were quick to support Trump, banking on the former-president to ease scrutiny on the environmental impact of the high-energy use process, curb competition from overseas and to roll back what they view as restrictive guidelines under the Biden administration. Trump’s support of crypto helped to generate about $135 million in campaign contributions during the last election cycle, the most by any one industry.

“President Trump campaigned on a vision for America to remain the world leader in the next frontiers of technology, from cryptocurrency to AI,” Trump-Vance Transition spokesman Kush Desai said in a statement. “The Trump-Vance administration will work with industry titans and unleash our talent and resources to ensure American leadership and innovation in every facet of the cryptocurrency industry, from mining to end-use solutions.”

Despite rapid expansion in the US and the latest bull run in the crypto market, economic sanctions by the US and rampant inflation in some emerging economies have spurred overseas miners to ramp up their operations even more.

“There is huge growth coming up in a few different markets,” said Taras Kulyk, chief executive of Synteq Digital, which is one of the largest brokers for specialized computers for Bitcoin mining. Eastern European countries such as Kazakhstan are seeing more demand, and “sales into Asia, Africa and the Middle East are all on the rise,” Kulyk said.

Large sales in Asia point to an increase in Bitcoin mining activities in China after a sweeping ban on such operations by the government in 2021. A loosening stance on crypto from Russia is also spurring a resurgence of the industry in the country, according to Kulyk.

For some African and South American countries, margins from Bitcoin mining are much larger compared to their US peers. Pockets of cheap energy are spread across Africa with hydro power-rich Ethiopia being one of the fastest growing crypto mining hubs on the continent. The US dollar-denominated mining revenue has provided a way to keep local operators in countries like Argentina out of the inflation spiral and preserve their savings.

Even US miners have embarked on overseas expansion as power costs in states such as Texas rise. MARA Holdings Inc., the largest miner by market cap, announced plans to form a joint venture with a local firm owned by a sovereign wealth fund in Abu Dhabi. The venture aims to build out one of the largest mining farms in the Middle East.

The operations within the US are not entirely dedicated to domestic miners either. Many miners provide hosting services, in which anyone either from the US or overseas can buy machines and pay the operations to run them and earn Bitcoin.

And there is another headwind Trump risks bringing upon the US miners. A trade war with China would likely raise the cost of Bitcoin mining machines, most of which are manufactured by a Chinese company Bitmain, especially given the fact machines are one of the two major expenses for miners besides electricity. But for many miners, the benefits from Trump outweigh the harm.

“Trump is probably the best thing for Bitcoin mining that could ever happen,” Kulyk said. “He is a pro-energy and pro-economic growth type of president.”

--With assistance from Stephanie Lai.

(Adds comment from a Trump spokesperson in the ninth paragraph.)