Happy New Year from MarketWatch!

As we near the end of 2024, we see a typical slew of articles on tax-loss harvesting — the practice of selling losing stock positions before the end of the year to avoid taxes by offsetting realized gains on other investments sold during the year.

This might seem to be a strange notion, as it is probably better to make money and pay taxes then to lose money and avoid taxes. But if you want to trade out of the losing positions anyway, you can offset higher amounts of capital gains booked during the current year than you might be able to if you sell the dogs next year. The IRS’s annual limit on capital-loss carry-overs to offset subsequent years’ gains is $3,000.

In the Need to Know column on Christmas Eve, Barbara Kollmeyer shared insights from strategists at Evercore ISI led by Julian Emanuel, who considered year-end selling action and corporate financial reports to list candidate stocks for rebounds in 2025 , including Nike Inc. NKE and many others.

Mark Hulbert dug into the technical aspects of year-end tax-loss selling, including the IRS “wash-sale” rule .

Michael Brush listed seven stocks that could rebound in January following tax-loss selling .

More about this year’s poor performers

Following the discussion of tax-loss selling, you might be wondering which stocks were left behind during what turned out to be another banner year for the S&P 500 SPX.

All returns in this article include reinvested dividends. The large-cap U.S. benchmark index was up 28.3% for 2024 through Thursday. But 30% of the index’s component stocks were down for the year. These 10 were the worst performers:

|

Company |

Ticker |

Total return for 2024 |

|

Walgreens Boots Alliance Inc. |

WBA |

-59.9% |

|

Moderna Inc. |

MRNA |

-59.3% |

|

Intel Corp. |

INTC |

-58.8% |

|

Celanese Corp. |

CE |

-54.6% |

|

Estée Lauder Cos. Inc. Class A |

EL |

-47.6% |

|

Dollar Tree Inc. |

DLTR |

-46.4% |

|

Enphase Energy Inc. |

ENPH |

-44.7% |

|

Humana Inc. |

HUM |

-43.6% |

|

Dollar General Corp. |

DG |

-43.3% |

|

Biogen Inc. |

BIIB |

-42.1% |

Click the tickers for more about each company.

Read: Tomi Kilgore’s guide to the wealth of information available for free on the MarketWatch quote page

A closer look at the bull market and its possible end

This year’s 28.3% return for the S&P 500 follows a 26.3% return in 2003. Wonderful. But the index was down 18.1% in 2022.

From the end of 2001, the return for the S&P 500 has been 32.7%, which isn’t out of line with the long-term trend. For 30 years through Thursday, the S&P 500’s average annual return was 11%, according to FactSet.

Now let’s take a look at market sector performance over the past few years. There really is no longer one “technology” sector. There are three, as we can see when we list the largest 10 holdings of the SPDR S&P 500 ETF Trust. SPY. Since the fund holds two common share classes of Alphabet Inc. GOOGL GOOG, here’s how the top 11 SPY stocks have performed:

|

Company |

Ticker |

Sector |

% of SPY portfolio |

Total return for 2024 |

|

Apple Inc. |

AAPL |

Information Technology |

7.66% |

35.2% |

|

Nvidia Corp. |

NVDA |

Information Technology |

6.71% |

182.6% |

|

Microsoft Corp. |

MSFT |

Information Technology |

6.37% |

17.4% |

|

Amazon.com Inc. |

AMZN |

Consumer Discretionary |

4.16% |

49.4% |

|

Meta Platforms Inc. |

META |

Communication Services |

2.57% |

71.1% |

|

Tesla Inc. |

TSLA |

Consumer Discretionary |

2.48% |

82.8% |

|

Broadcom Inc. |

AVGO |

Information Technology |

2.24% |

122.7% |

|

Alphabet Inc. Class A |

GOOGL |

Communication Services |

2.24% |

40.5% |

|

Alphabet Inc. Class C |

GOOG |

Communication Services |

1.83% |

40.4% |

|

Berkshire Hathaway Inc. Class B |

BRK.B |

Financials |

1.65% |

28.7% |

|

JPMorgan Chase & Co. |

JPM |

Financials |

1.34% |

46.3% |

|

Sources: State Street, FactSet |

||||

So our three “tech” sectors really are the information technology sector, the consumer discretionary (which includes Amazon.com AMZN and Tesla TSLA) and the Communication Services (Meta Platforms META and Alphabet).

Here is a summary of how the sectors of the S&P 500 have performed, with the full index at the bottom:

|

Index or sector |

Total return for 2024 |

2023 return |

2022 return |

Return since end of 2021 |

|

Communication Services |

44.2% |

55.8% |

-39.9% |

35.1% |

|

Information Technology |

41.7% |

57.8% |

-28.2% |

60.6% |

|

Consumer Discretionary |

36.1% |

42.4% |

-37.0% |

22.1% |

|

Financials |

32.7% |

12.1% |

-10.5% |

33.1% |

|

Utilities |

24.4% |

-7.1% |

1.6% |

17.4% |

|

Industrials |

19.7% |

18.1% |

-5.5% |

33.7% |

|

Consumer Staples |

16.8% |

0.5% |

-0.6% |

16.6% |

|

Real Estate |

5.8% |

12.4% |

-26.1% |

-12.2% |

|

Energy |

4.4% |

-1.3% |

65.7% |

70.7% |

|

Health Care |

4.1% |

2.1% |

-2.0% |

4.2% |

|

Materials |

1.5% |

12.5% |

-12.3% |

0.2% |

|

S&P 500 |

28.3% |

26.3% |

-18.1% |

32.7% |

|

Healthcare |

||||

And now for a warning from Mark Hulbert: All these market indicators point to stocks struggling during Trump’s presidency

When will it be time to worry about Nvidia?

Shares of Nvidia NVDA were up nearly 83% for 2024 through Thursday, but there have been some jitters this month, with the stock falling 14% over three trading sessions through Dec. 20, before it perked up again.

Tomi Kilgore analyzed technical factors for Nvidia back in September, but the lessons still hold. These price movement trends would signal a significant decline for Nvidia’s stock .

Don’t miss: Cathie Wood’s ETF keeps selling Tesla stock even as she gets more bullish

Warren Buffett’s stock pick

Berkshire Hathaway and its CEO Warren Buffett keep adding shares of this company to their investment portfolios. Here’s what may be driving their thinking .

Brett Arends: Warren Buffett stocks for your IRA in 2025

Here’s how MicroStrategy overpays for bitcoin

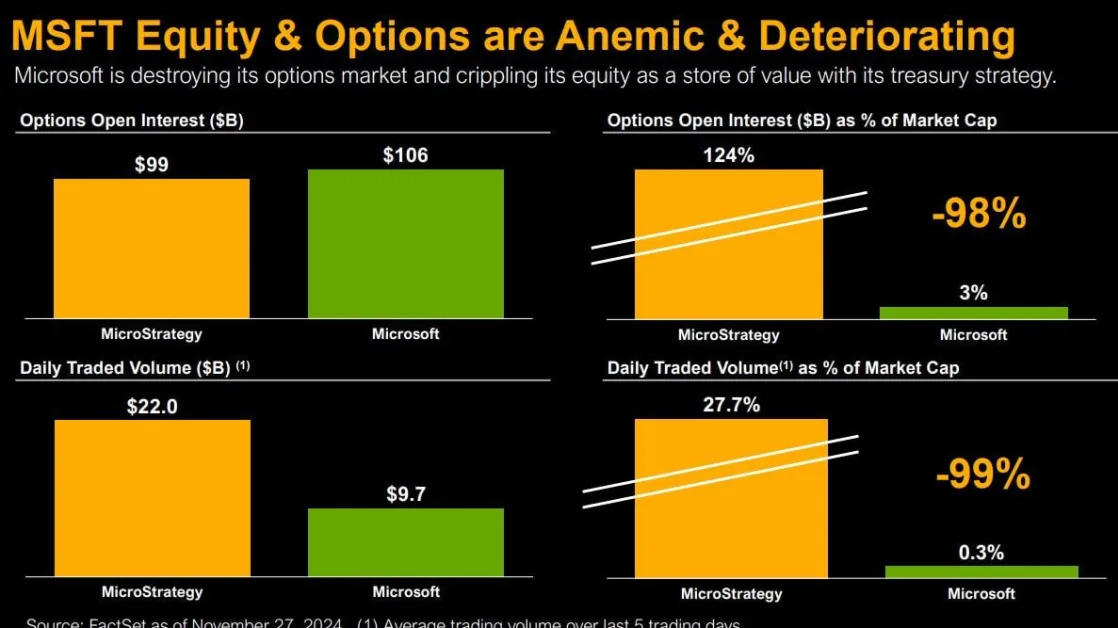

MicroStrategy Inc. MSTR is a meme stock — it trades on momentum. The company invests in bitcoin BTCUSD, while its business strategy includes “developing product innovations that leverage bitcoin blockchain technology,” and “periodically engaging in advocacy and educational activities regarding the continued acceptance and value of bitcoin as an open, secure protocol for an internet-native digital asset and the Lightning Network,” according to it its most recent 10-K annual report filed with the Securities and Exchange Commission in February.

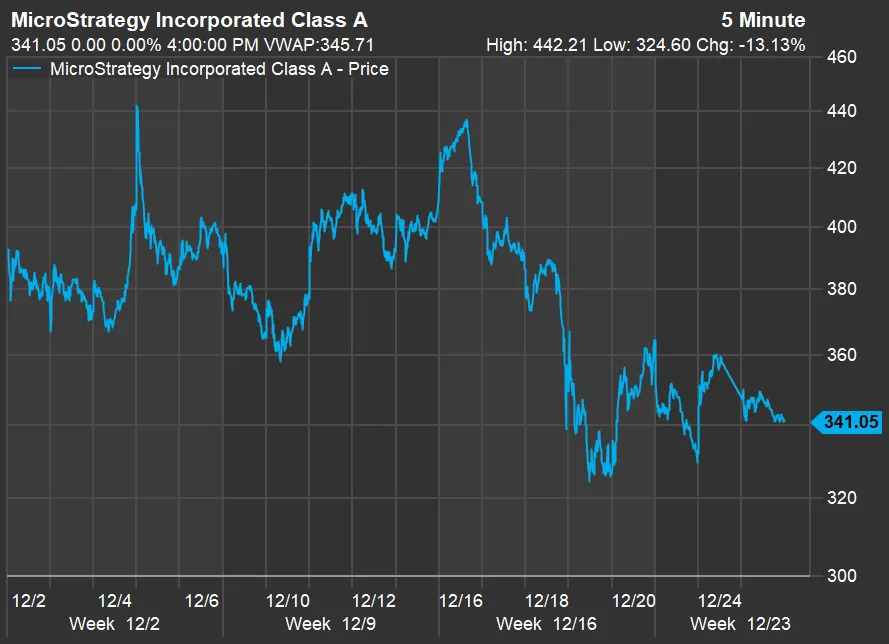

MicroStrategy’s stock was up 440% for 2024 through Thursday, but as you can see on the above December price chart, this is a risky name for day-traders. The company reported a net loss of $340 million for the third quarter and a combined net loss of $496 million for the first three quarters of 2024.

Tomi Kilgore reported on how MicroStrategy was paying way above market for its recent bitcoin purchases .

More coverage of the virtual currencies

Another prominent virtual-currency-related stock that has performed well this year is Coinbase Global Inc. COIN, which provides various account and trading services for investors and traders. The company reported profits for the third quarter and for the first three quarters of 2024, and its stock was up 58% for 2024 through Thursday. In this week’s Distributed Ledger newsletter, Frances Yue shared an aggressive prediction from Matthew Hougan, chief investment officer at crypto asset manager Bitwise Asset Management, about how large Coinbase might become in 2025 .

Gordon Gottsegen: Small retail investors hold about 9.5% of bitcoin. Here’s why that doesn’t tell the full story.

More: Bitcoin may reach cycle peak in three weeks if history repeats itself — but watch for these barriers

A TIPS tax warning

Treasury Inflation Protection Securities can provide comfort to investors who have gotten burned by inflation and want to mitigate the risk of holding long-term bonds when interest rates are rising. But they also face tax burdens that they might not have considered. Beth Pinsker explains t his other element of risk that you need to think about if you hold TIPS .

More changes ahead for people with student debt

Jillian Berman explains what may lie ahead for people in the U.S. with student debt during President-elect Donald Trump’s second term in office, and shares practical advice on pitfalls to avoid .