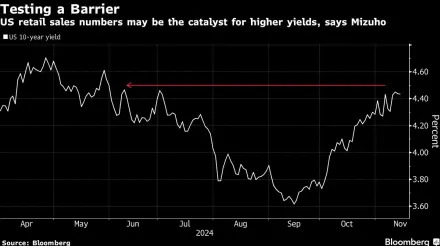

Citadel Securities’ Inflation Head Says Tariffs No Worry for Fed

(Bloomberg) -- Citadel Securities’ Durham Abric says the Federal Reserve’s interest-rate path probably will be uninterrupted by the incoming Trump administration’s protectionist posture.Most Read from BloombergUnder Trump, Prepare for New US Transportation PrioritiesZimbabwe City of 700,000 at Risk of Running Dry by Year-EndSaudi Neom Gets $3 Billion Loan Guarantee From Italy Export Credit Agency SaceThe Urban-Rural Divide Over Highway Expansion and Emissions“The Fed is likely to look past the i