Information

- Oct 09, 2024

RBC BlueBay Sees Risk of Trump, Harris Policies Fueling Fed Hike

(Bloomberg) -- There is a risk the Federal Reserve has to raise interest rates next year given the inflationary policy platforms of both US presidential candidates, according to Mark Dowding, the chief investment officer at RBC BlueBay Asset Management.Most Read from BloombergUrban Heat Stress Is Another Disparity in the World’s Most Unequal NationFrom Cleveland to Chicago, NFL Teams Dream of Domed StadiumsChicago’s $1 Billion Budget Hole Exacerbated by School TurmoilSingapore Ends 181 Years of

- Oct 09, 2024

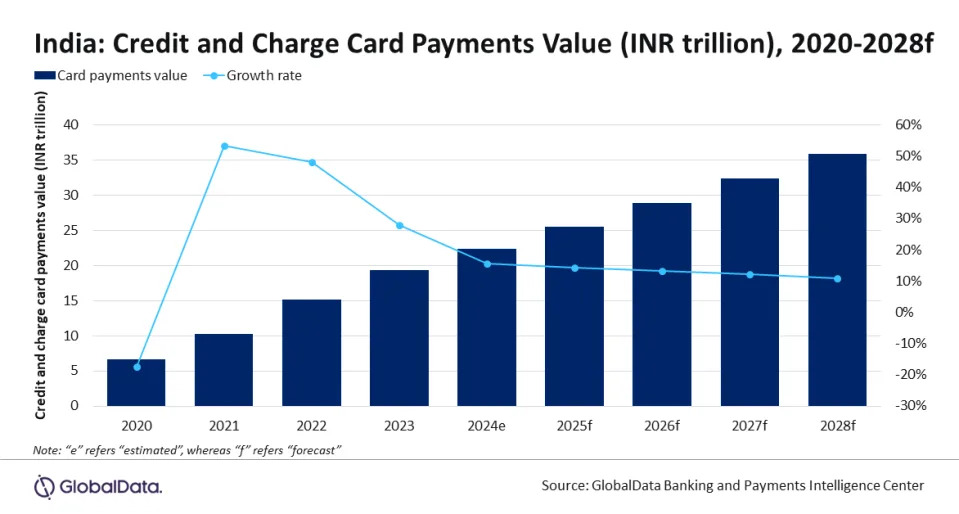

India credit and charge card payments market to grow by 15.5% in 2024, forecasts GlobalData

Successful government initiatives and increasing consumer confidence in electronic payments combine to accelerate cash displacement

- Oct 09, 2024

Analysts update Meta stock price target with Q3 earnings in focus

Meta Platforms, the parent of Facebook, has added nearly $600 billion in market value this year.

- Oct 09, 2024

Stocks Decline Pre-Bell as Investors Await Fed Minutes; Asia Churns, Europe Strong

Stocks Decline Pre-Bell as Investors Await Fed Minutes; Asia Churns, Europe Strong

- Oct 09, 2024

Oil slips as strong supply counters Middle East and hurricane risk

Oil prices erased early gains on Wednesday as weak demand fundamentals and rising supply countered elevated risk of supply disruption from conflict in the Middle East and Hurricane Milton in the United States. Brent crude futures fell 40 cents, or 0.4%, to $76.81 a barrel by 1028 GMT while U.S. West Texas Intermediate futures lost 36 cents, or 0.49%, to $73.21. "We have quite the tug-of-war between the bulls and the bears, with the former pinning expectations of higher prices on Middle Eastern geopolitics while the latter are looking at weak demand and a lack of fiscal stimulus in China," said Harry Tchilinguirian, head of research at Onyx Capital Group.

- Oct 09, 2024

Stock market today: Dow, S&P 500, Nasdaq futures stall with Fed and Google breakup in focus

Investors are locked in debate over a 'no landing' for the economy, with Fed minutes on deck.

- Oct 09, 2024

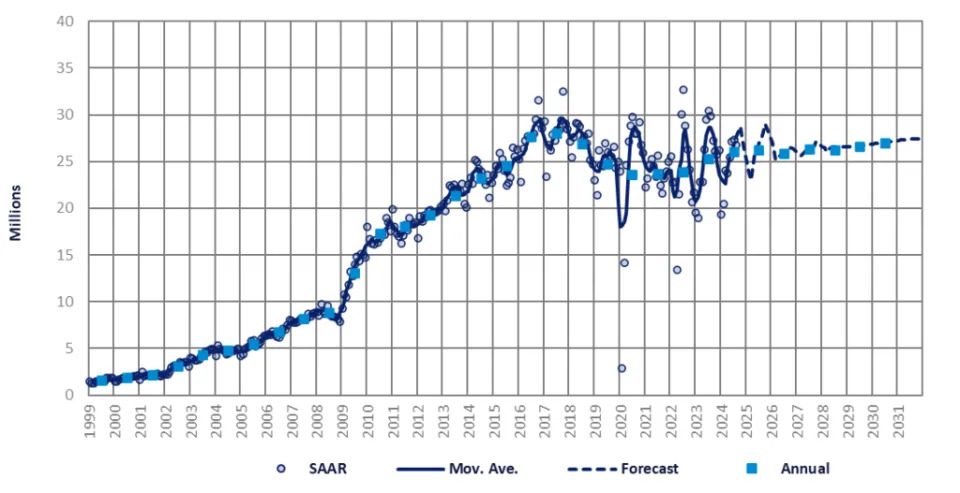

China vehicle market being supported by NEV incentives

In August 2024, China's automotive market exhibited a positive month-on-month (MoM) growth trajectory

- Oct 09, 2024

Jamie Dimon backs Jerome Powell’s rate cut strategy

"They were late raising rates but they raised very high, rapidly, to 5% which I think is the right thing," JP Morgan's Jamie Dimon said. "And they're right to take the foot off the gas on that one."