Information

- Sep 11, 2024

Fed official broke ethics rules but didn't violate insider trading laws, probe finds

A government investigation into Atlanta Federal Reserve President Raphael Bostic's securities trades and investments has found he violated several of the central bank's ethics policies. The Fed rules violations “created the appearance” that Bostic acted on confidential Fed information and that he had a conflict of interest, but the Fed's Office of Inspector General concluded there were no violations of federal insider trading or conflict of interest laws, according to a report issued Wednesday. The probe reviewed financial trades and investments in a roughly five-year period starting in 2017 made by several investment managers on Bostic's behalf — transactions that in October 2022 he said he had been initially unaware of.

- Sep 11, 2024

Fed Watchdog Found No Proof Bostic Traded on Inside Information

(Bloomberg) -- The US central bank’s internal watchdog chastised Federal Reserve Bank of Atlanta President Raphael Bostic for his previously reported violations of the Fed’s investment restrictions, but said it found no evidence that he made trades based on confidential information.Most Read from BloombergHow Americans Voted Their Way Into a Housing CrisisFor Tenants, AI-Powered Screening Can Be a New Barrier to HousingAfter a Record Hot Summer, Pressure Grows for A/C MandatesChicago Halts Hirin

- Sep 11, 2024

Atlanta Fed's Bostic violated trading rules, US central bank watchdog says

(Reuters) -Federal Reserve Bank of Atlanta President Raphael Bostic's trading and investing broke central bank rules, the Fed's in-house watchdog said on Wednesday. Bostic created the appearance he acted on confidential information and the appearance of a conflict of interest, in violation of the Atlanta Fed's code of conduct, according to a report by the Office of Inspector General for the central bank. However, the report said investigators found no evidence that Bostic in reality used inside information about Fed deliberations or had financial conflicts of interest.

- Sep 11, 2024

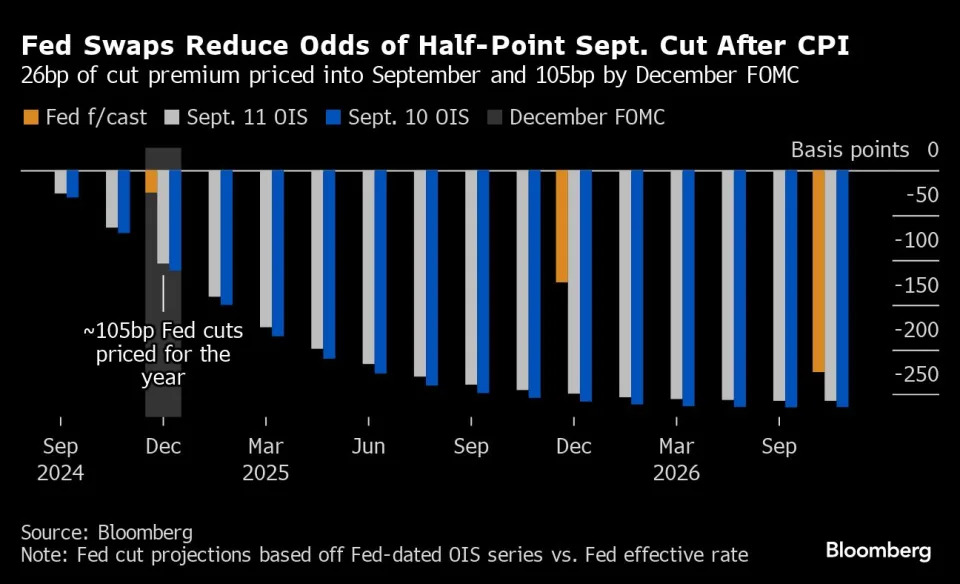

Bond Market’s Bet on a Half-Point Fed Cut This Month Is Over

(Bloomberg) -- The bond market has ended its long flirtation with the Federal Reserve cutting interest rates by half a point this month as resilient inflation and labor market data reinforce a measured course of action.Most Read from BloombergHow Americans Voted Their Way Into a Housing CrisisFor Tenants, AI-Powered Screening Can Be a New Barrier to HousingAfter a Record Hot Summer, Pressure Grows for A/C MandatesChicago Halts Hiring as Deficit Tops $1 Billion Through 2025UC Berkeley Gives Trans

- Sep 11, 2024

Blackstone Finance Chief Chae Says US Inflation Is ‘at Target’

(Bloomberg) -- Blackstone Inc. Chief Financial Officer Michael Chae said the firm is “cautiously optimistic about a soft landing,” signaling the alternative asset manager is betting the Federal Reserve’s efforts to tamp down inflation won’t trigger a US recession. Most Read from BloombergHow Americans Voted Their Way Into a Housing CrisisFor Tenants, AI-Powered Screening Can Be a New Barrier to HousingAfter a Record Hot Summer, Pressure Grows for A/C MandatesChicago Halts Hiring as Deficit Tops

- Sep 11, 2024

Argentina's August inflation still stubborn as residents struggle to save

BUENOS AIRES (Reuters) -Argentina's monthly inflation rate stood at 4.2% in August, official data published on Wednesday showed, rising from last month and surpassing analysts' forecasts, while Argentines tighten their wallets to deal with spiraling costs. Inflation in the 12 months through August reached 236.7%, still the highest level recorded in the world, and also above a Reuters poll forecast of 235.8%. Analysts had hoped for a slight monthly slowdown to 3.9%, which would signal progress for the government of libertarian President Javier Milei, which has been focused on taming runaway prices.

- Sep 11, 2024

Oil Jumps as US Gulf Hurricane Spurs Short-Covering by Traders

(Bloomberg) -- Oil climbed the most in two weeks as Hurricane Francine ripped through key oil-producing zones in the US Gulf of Mexico, prompting traders to cover bearish bets. Most Read from BloombergHow Americans Voted Their Way Into a Housing CrisisFor Tenants, AI-Powered Screening Can Be a New Barrier to HousingAfter a Record Hot Summer, Pressure Grows for A/C MandatesChicago Halts Hiring as Deficit Tops $1 Billion Through 2025UC Berkeley Gives Transfer Students a Purpose-Built Home on Campu

- Sep 11, 2024

Trump's election odds slipping doesn't bode well for crypto

Trump's odds of winning the election slipped after the debate, which could spell a rough road ahead for crypto