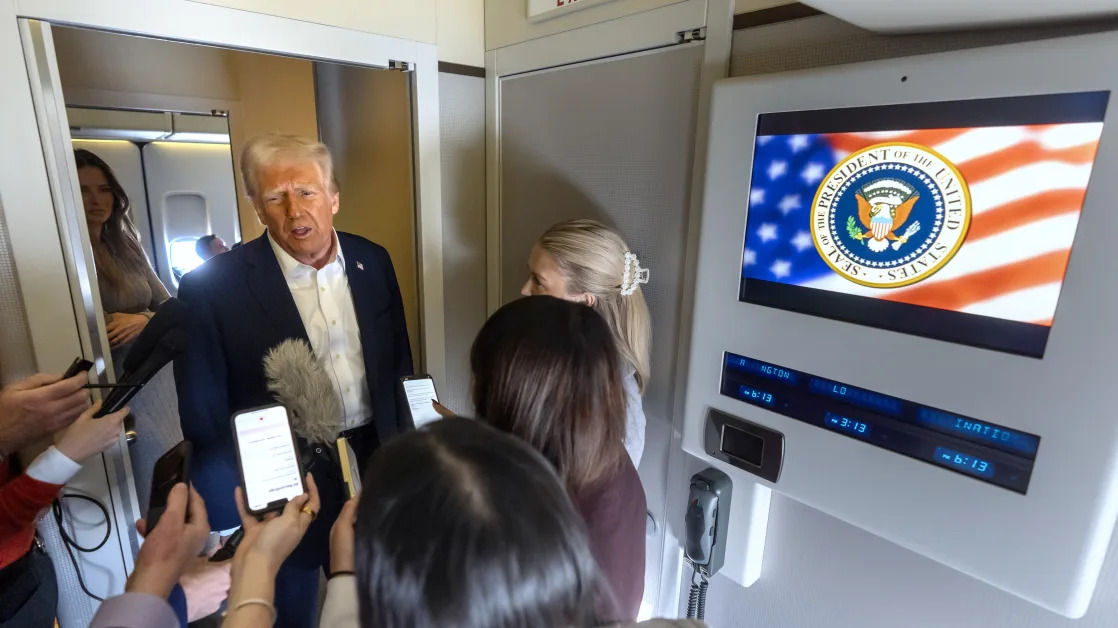

Point72’s Cohen says Trump’s policies could halt markets' rise this year

Point72 Asset Management's founder Steven Cohen said on Tuesday that he would expect the stock market to reach a peak soon amid inflation pressure and uncertainties around U.S. President Donald Trump's policies on tariffs and immigration. Trump has threatened to impose a universal tariff on foreign-imported goods and others aimed at specific sectors or countries, while on the immigration front he has launched a sweeping border crackdown. Such measures would "actually slow growth, not increase growth in 2025" and make it more difficult for the Federal Reserve to tackle inflation, Cohen said at the investment conference iConnection, in Miami.